Fools gold as I assume every other timeshare executive felt the same way.DVD is likely looking at the net results. Profit gains offsetting losses. Direct contracts being more desirable, profit on transfer, and profit on upgrades can offset loss of some sales if they are able to protect the direct experience and upgrade experience. Most buyers are not deciding to purchase on potential future resale value alone. In the past it has worked out well but still - was never 100% dependable.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Ft. Wilderness Cabins becoming DVC?

- Thread starter hglenn

- Start date

Mikey15

DIS Veteran

- Joined

- Aug 29, 2018

- Messages

- 1,541

Without searching back 10-20 pages, wasn’t the date of the unanimous vote and all the signatures on the CFW/Palmetto Trust documents sometime in October/November? Ahead of the infamous meeting & quote? And the CFW/Trust decision would have been known and plans in place prior to stating that Poly Tower wouldn’t be a separate “association” at PVB?That is why I am leaning that it’s going to go into the trust and not to PVB…regardless of the statement at the meeting….because I think the plan at that time was the trust, but since it wasn’t finalized, the back up plan was PVB. I could end up 100% wrong.

Even CFW is not going to be its own. association. The trust is the association and CFW cabins are simply the resort property that is in the trust

View attachment 823471

So, technically, Poly tower would not be a new association IF they add it to the trust…it would simply become a second resort property with this one association.

Maybe that is why they had been so vague for the past almost two years about the tower project?

But, could they decide to make a reciprocal agreement between the trust association and PVB owners for equal access to all DVC located at Poly resort? My guess is only with the approval and vote of current owners who’d have to agree to let the trust members have access to their property.

And, with this discussion about PVB longhouses, tower, and new vacation plan part of PVB, it’s really about the bigger picture in terms of what it can do with units at sold out resorts.

I see it as the same…if they can’t add partial units at sold out resorts so trust owners have access…and I don’t think the law allows that…I don’t think the longhouses and bungalows at PVB get to be treated differently, just because they built the tower at the same WDW resort.

I think we probably agree that none of this is coincidence, and that the timing and language have meaning. My reading between the lines is a bit different though. From the start of this thread people have been speculating about Disney’s (in)ability to sell FW Cabins with one room type as a standalone resort, being a niche market, resale restrictions, so on. CFW and Poly tower going on sale at the same time as trust-owned RTU property solves some problems for them on that front, depending on how it all works.

There’s different ways the “vacation use plans” can be structured. A lot of people here on DIS understandably have pessimistic expectations of how it’ll turn out, but the worst case scenarios aren’t foregone conclusions either. I don’t see why it’d be I’m possible for PVB to be a single association (for owners meetings, determining dues per point at the resort, etc), current owners to have 11mo booking capability at the tower, AND the trust to be the legal owner of the tower half of those points. It’d be a new arrangement for sure, but it could allow them to sell a trust membership with broader booking capabilities than “just” CFW.

I think this is why several of us think @Brian Noble is onto something about this possibly being more to make it easier for Disney to foreclose on those not paying mortgages and dues.Ive been quiet on this and mostly just enjoying the analysis of the Trust setup. But man, I cant help but think the sales people are gonna have a hard time explaining this to the simpletons (and even the brainiacs that over analyze everything) a trust with PVB and the CFW, etc. Im sure they have a hard time explaining Use Years still (and myself having an issue trying to get family, young and old alike to understand) as well as restrictions, etc. Most sales people will tell you they dont want 2 or more products to sell because it causes people to over analyze, and the last thing they want to hear is "Let me think about it..." Now they will have home resorts to sell (Legacy) as well as a trust system.

Will the Trust System have UY's ? or will it be calendar based?

Good luck to the guides.

Same here although I am hoping to keep my contracts until they expire.I am one of the many that never would have purchased DVC if the resale value sucked. The same reason I've never purchased a different timeshare before or after.

It's a very short sighted move if they make it, that let's face it none of the people making the decisions will be around to see the consequences.

Genie+

You can never spend enough

- Joined

- May 12, 2022

- Messages

- 6,383

Fools gold as I assume every other timeshare executive felt the same way.

I totally get it about DVD/DVC potentially devaluing the product and what that means to me as a buyer/user. Those concerns are what dragged my feet for years and what ultimately had me pick VGF direct as the best fit with the least risk for us personally.

But DVD cares about all that differently than I. They see a direct purchase choice that is so far satisfied. They did not ‘lose’ me to resale which was fully our original intention. And in the future if I decide SSR at $50pp is just too good to pass up, they may happily take more of my money to reinstate full range of use.

- Joined

- Nov 15, 2008

- Messages

- 48,486

Without searching back 10-20 pages, wasn’t the date of the unanimous vote and all the signatures on the CFW/Palmetto Trust documents sometime in October/November? Ahead of the infamous meeting & quote? And the CFW/Trust decision would have been known and plans in place prior to stating that Poly Tower wouldn’t be a separate “association” at PVB?

I think we probably agree that none of this is coincidence, and that the timing and language have meaning. My reading between the lines is a bit different though. From the start of this thread people have been speculating about Disney’s (in)ability to sell FW Cabins with one room type as a standalone resort, being a niche market, resale restrictions, so on. CFW and Poly tower going on sale at the same time as trust-owned RTU property solves some problems for them on that front, depending on how it all works.

There’s different ways the “vacation use plans” can be structured. A lot of people here on DIS understandably have pessimistic expectations of how it’ll turn out, but the worst case scenarios aren’t foregone conclusions either. I don’t see why it’d be I’m possible for PVB to be a single association (for owners meetings, determining dues per point at the resort, etc), current owners to have 11mo booking capability at the tower, AND the trust to be the legal owner of the tower half of those points. It’d be a new arrangement for sure, but it could allow them to sell a trust membership with broader booking capabilities than “just” CFW.

No. December 13th and December 15th are the dates on the actually filed documents.

The trust info that showed up on SunBiz site was dated earlier.

My reasoning is based on the actual 115 page trust associations documents.

They created a brand new association which is trust based one.

They set it up that they can add one or more resort plans to it to govern whatever resort property is in it.

So, in that sense, it’s no different than each individual association out there except the current ones are leasehold condominiums.

Right now, the property thst has been activated in the trust is the resort property..cabins..at FW.

They created the Cabons Resort use plan which has all its rules and regulations, including the DVC membership agreement and DVC resort agreements.

Based in all of that, just like current resort owners only have access to property declared into their respective condo associations, the trust beneficiaries will only have access to the resort properties in their association…which right now is only the 30 cabins..until they can trade via BVTC like the rest of us.

Just like current owners who own inventory in one association can’t access other inventory in a different one, I don’t see how owners of the PVB association would be given special access to trust resorts, including the Poly tower rooms if they are under their own vacation plan, even if that vacation plan is under the big PVB umbrella.

We already know the declarations have info that appears to suggest that beneficiaries of the trust will end up with home resort booking at all trust resort properties.

To be honest, I actually don’t think we are going to see that..I lean 75/25 thst the tower becomes part of the trust association and not PVB…and that DVC will say that they decided to change plans.

Of course’s they could decide to put a few units into the PVB vacation plan and sell the same way as always and add the others to the trust?

I have sent my 5th email today to them and asked for a call as well as more info. We shall see if I get a different response than “sorry, we can’t answer you” regarding the projects.

Last edited:

Yes, I'd point out Marriott vacation club stock is about even with where it was 5 years ago, meanwhile Marriott Resorts (Hotels) is nearly double in the same timeframe.Fools gold as I assume every other timeshare executive felt the same way.

Hilton Grand Vacations traded at $30 a share 5 years ago, $40 today. Hilton Hotels meanwhile $74 vs. $180 today.

Wyndham/Travel & Leisure timeshares essentially flat, Wyndham Hotels doubled.

Timeshares are a dying business.... DVC was one of the few long term success stories in the industry....

Disney is copying the moves of these failing timeshare companies... While some may say "restrictions don't matter", "trusts don't matter", etc. word has gotten out about the timeshare industry, and customers are not eager to be tied to these companies known for their questionable practices.

Disney has avoided that reputation, and the more they adopt these schemes like resale restrictions, trust products (which I long suspected they would eventually do), and provide little to no communication to owners about what they are planning, people will be turned off, and just not buy points.

Disney stock by the way has also suffered terribly over the past 5 years.... down nearly 20% in that time... One of the things that has been propping their company up has been parks and resorts... They are scraping the bottom of the barrel with many shady tactics to use park money to cover the ineptitude out of the rest of the company.

Mikey15

DIS Veteran

- Joined

- Aug 29, 2018

- Messages

- 1,541

This all is why I’m thinking what I’m thinking though:Just like current owners who own inventory in one association can’t access other inventory in a different one, I don’t see how owners of the PVB association would be given special access to trust resorts, including the Poly tower rooms if they are under their own vacation plan, even if that vacation plan is under the big PVB umbrella.

We already know the declarations have info that appears to suggest that beneficiaries of the trust will end up with home resort booking at all trust resort properties.

Step 1. PVB (~4,000,000 points) adds tower (say another ~4,000,000 points) for an expanded (~8,000,000 point) resort.

2. Trust buys ~4,000,000 points

3. Trust sells use rights equivalent to these points to trust beneficiaries

4. Beneficiaries have 11-7 month home resort booking window at properties owned by trust, which would include trust-declared units of CFW and ~4,000,000 points worth of Polynesian

5. A PVB point would still be a PVB point… existing owners could book tower rooms in the 11-7mo window. The trust could book longhouse rooms on behalf of its beneficiaries. Existing deeded PVB owners, however, wouldn’t have some sort of special access to other points owned by the trust.

6. DVD wouldn’t be selling new “owners” PVB points, but rather interests in a trust that owns PVB points

The result could be that Trust beneficiaries would have 11-7mo booking priority at such resorts, to the extent that the trust owns points of them. I think this is where it might get complicated, but functionally it’s kind of like a really big LLC. If an LLC owned 2,000 points at a given resort, it can’t make reservations for its owners that exceed that in a year, outside of year-shifting measures like banking & borrowing. If the trust owns 4,000,000 Poly points, it can’t book stays for trust beneficiaries that exceed that. Room availability is a finite resource, but so is points available for booking.

Moreover, there’s been serious speculation about the Trust adding other Active Sales resorts like Aulani or Riviera. If the trust can take ownership of the remaining undeclared ~25% of points at those resorts, and then sell trust memberships predicated on being able to book there, wouldn’t that be the same as the trust taking ownership of 50% of an expanded PVB? What would be the difference, beyond it occurring right as the new building is added?

This I think people could come around to supporting. You no longer have a deeded interest, you have a right to use these points... Especially if the contract has language that makes clear points can't be magically added.Just like current owners who own inventory in one association can’t access other inventory in a different one, I don’t see how owners of the PVB association would be given special access to trust resorts, including the Poly tower rooms if they are under their own vacation plan, even if that vacation plan is under the big PVB umbrella.

This I would find much harder to support as a buyer... I'm not interested in having to be in the soup from day one with everyone else...We already know the declarations have info that appears to suggest that beneficiaries of the trust will end up with home resort booking at all trust resort properties.

In other words, I'd consider buying Poly if it were a trust product but I had my 11 month window as a Poly owner. I would not consider buying it if CFW, Villas at Caribbean Beach, Villas at All Star Movies, etc. are able to to get the same priority for Polynesian as I am.

If Disney wanted to make a trust of Moderates and Value DVC resorts, and I didn't have to deal with it, I could care in the least.

- Joined

- Nov 15, 2008

- Messages

- 48,486

This all is why I’m thinking what I’m thinking though:

Step 1. PVB (~4,000,000 points) adds tower (say another ~4,000,000 points) for an expanded (~8,000,000 point) resort.

2. Trust buys ~4,000,000 points

3. Trust sells use rights equivalent to these points to trust beneficiaries

4. Beneficiaries have 11-7 month home resort booking window at properties owned by trust, which would include trust-declared units of CFW and ~4,000,000 points worth of Polynesian

5. A PVB point would still be a PVB point… existing owners could book tower rooms in the 11-7mo window. The trust could book longhouse rooms on behalf of its beneficiaries. Existing deeded PVB owners, however, wouldn’t have some sort of special access to other points owned by the trust.

6. DVD wouldn’t be selling new “owners” PVB points, but rather interests in a trust that owns PVB points

The result could be that Trust beneficiaries would have 11-7mo booking priority at such resorts, to the extent that the trust owns points of them. I think this is where it might get complicated, but functionally it’s kind of like a really big LLC. If an LLC owned 2,000 points at a given resort, it can’t make reservations for its owners that exceed that in a year, outside of year-shifting measures like banking & borrowing. If the trust owns 4,000,000 Poly points, it can’t book stays for trust beneficiaries that exceed that. Room availability is a finite resource, but so is points available for booking.

Moreover, there’s been serious speculation about the Trust adding other Active Sales resorts like Aulani or Riviera. If the trust can take ownership of the remaining undeclared ~25% of points at those resorts, and then sell trust memberships predicated on being able to book there, wouldn’t that be the same as the trust taking ownership of 50% of an expanded PVB? What would be the difference, beyond it occurring right as the new building is added?

You have to forget points. it’s about inventory….in order for all inventory at the current PVB and the tower to be all the same home resort…it has to be declared into the current PVB vacation plan.

The only way I see that the PVB condo association can have the Poly tower units added to it and still be part of the trust association is to create a brand new vacation plan in PVB. Meaning PVB now has two distinct plans that run side by side, not together.

All owners, whether PVB or any other resort, only have the right to book inventory declared under their vacation plan to their home resort.

We will have to see what they do but I do not believe they can, and don’t believe the documents would allow anyone who is not a trust beneficiary to book resort property activated to the trust association and I don’t believe that the current longhouses.bungalows, as well as ever other unit declard at sold out resorts, can be added to the trust without the owners say so.

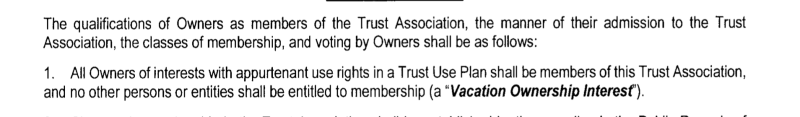

This clause appears to me to say that only those with an interest in the plans can take part in the trust, which would seem to leave out current owners of any of the current resorts…including PVB owners.

I think some think of the trust as an “owner” like an LLC can be…and it can buy inventory,,, I did at one point..,but reading the documents, it doesn’t seem to work like that at all,

it is an actual timeshare association, which is governed by laws and the rules of its assocation, by laws, etc. It adds a resort property to it…and then activates those units into the RTU plan for those to buy.

So, DVD is adding the resort property to the trust assocation and then sells it like that. But it remains owned by DVD within the trust assocation until someone buys intp the RTU plan…

It is also why the more I read, the more I realize that even putting it in to PVB under a new vacation plan just makes it messy and DVD has not real reason to do that…just make it a resort property in the same assocation as the cabins at CFW.

That’s the big difference between the trust association like DVD has created and the current associations. It can have inventory from many different locations under the same association.

Last edited:

DonMacGregor

Sub Leader

- Joined

- May 13, 2021

- Messages

- 6,595

My take on it is this:Ive been quiet on this and mostly just enjoying the analysis of the Trust setup. But man, I cant help but think the sales people are gonna have a hard time explaining this to the simpletons (and even the brainiacs that over analyze everything) a trust with PVB and the CFW, etc.

From 1/1/24 forward, every (huge grain of salt) "new" DVC resort will be placed into the trust, and new owners will be sold RTU's and not leasehold shares. Other than that, nothing else will be different. The system of reserving villas will be the same, with the same direct/resale restrictions. The "new" resorts will be included in the BVTC, and everyone will still have 11/7 month booking windows. Existing leasehold resorts will continue to sell as-is until they reach the sold-out threshold.

The only "fly" in that ointment is the Poly tower. For purposes of consistency, I think it will be a new association, and that they won't be building any significant additions to any other existing resorts. Beyond that, the only difference will be that owners of the "new" resorts will have a RTU ownership, versus existing members who have leaseholds. Once they add the Poly tower anomaly to the trust, everything will be the same moving forward, and unless you compare contract language for ownership type, you won't know one from the other.

The only people who will be pissed, are existing Poly owners, but even they won't have suffered any injury (beyond a busier resort), because they will still have access to the same rooms they have now and any new tower rooms won't be any different than if they had built it across the street at Shades of Green.

Then again, I'm an Occam's Razor, K.I.S.S. kinda guy...

Last edited:

I don't think that inventory must be declared into the trust to be used by the trust. At least in looking at Marriott's model, my impression is they never declared property into the trust. They just issued Notices of Addition. This doesn't prevent Marriott from issuing deeds for Trust point buyers.You have to forget points. it’s about inventory….in order for all inventory at the current PVB and the tower to be all the same home resort…it has to be declared into the current PVB vacation plan.

I get declaring CFW since it is only the trust. But is there a requirement that additional property would need to be declared into the trust? I don't really think so...

This is the gist of Marriott's model:

To create the MVC Trust, Marriott deeded its Legacy timeshare condominiums to First American as trustee of the MVC Trust, with all beneficial interests in the MVC Trust vesting in Marriott, the beneficiary. As Marriott adds new properties to the MVC Trust, Marriott records Notices of Addition (“NOAs”) in the public land records of Orange County. The NOAs contain a description of the newly-added properties as well as the point value Marriott has assigned to those properties (“Points for Sale”), which are unitized in tranches of 250 points, called beneficial interests (“BIs”), and sold to consumers as timeshare estates. (Id.). However, property added to the MVC Trust via an NOA is not immediately made available for use by timeshare owners (“MVC Trust Owners”). MVC Trust Owners are only permitted to use a new property once Marriott, in its discretion, delivers a Notice of Use Right (“NOU”) for the property to the MVC Trust managing entity, MVC Trust Owners Association, Inc. (“MVCTOA”). (Id.). After an NOU is delivered, the points from the newly-added Trust Property are sold to consumers, and MVC Trust Owners’ interests in the MVC Trust are recalibrated to account for the additional points. MVC Trust Owners then utilize their points to book accommodations, the cost of which is reflected as Points for Use.

Last edited:

Brian Noble

Gratefully in Recovery

- Joined

- Mar 23, 2004

- Messages

- 19,819

I'm not sure I'd make arguments on stock prices given what Disney's has been doing. In your five year window you list MVC flat, HGV +33%, T&L flat.stock

Disney? Down almost 18%.

In light of that, Timeshare could be a better-than-average business for the Mouse.

- Joined

- Nov 15, 2008

- Messages

- 48,486

I don't think that inventory must be declared into the trust to be used by the trust. At least in looking at Marriott's model, my impression is they never declared property into the trust. They just issued Notices of Addition. This doesn't prevent Marriott from issuing deeds for Trust point buyers.

I get declaring CFW since it is only the trust. But is there a requirement that additional property would need to be declared into the trust? I don't really think so...

This is the gist of Marriott's model:

To create the MVC Trust, Marriott deeded its Legacy timeshare condominiums to First American as trustee of the MVC Trust, with all beneficial interests in the MVC Trust vesting in Marriott, the beneficiary. As Marriott adds new properties to the MVC Trust, Marriott records Notices of Addition (“NOAs”) in the public land records of Orange County. The NOAs contain a description of the newly-added properties as well as the point value Marriott has assigned to those properties (“Points for Sale”), which are unitized in tranches of 250 points, called beneficial interests (“BIs”), and sold to consumers as timeshare estates. (Id.). However, property added to the MVC Trust via an NOA is not immediately made available for use by timeshare owners (“MVC Trust Owners”). MVC Trust Owners are only permitted to use a new property once Marriott, in its discretion, delivers a Notice of Use Right (“NOU”) for the property to the MVC Trust managing entity, MVC Trust Owners Association, Inc. (“MVCTOA”). (Id.). After an NOU is delivered, the points from the newly-added Trust Property are sold to consumers, and MVC Trust Owners’ interests in the MVC Trust are recalibrated to account for the additional points. MVC Trust Owners then utilize their points to book accommodations, the cost of which is reflected as Points for Use.

From my reading of the current rules and regulations, covenants and everything of the current trust DVC set up, yes, resort property has to be declared into the trust and then all or part of that resort property gets activated for use in the RTU plans, which then can be sold.

No idea how it is or is not different from Marriott . I am looking only at the way DVC set it up…as I said, CFW resort use plan is only the first resort and plan declared and partially activated into the trust. But, it definitely appears they plan to add more resort property and add more resort use plans in the future.

If you are reading something in the DVC trust associations filings that says differently, I’d love to see what part of it you interpret that way.

What you quote for Marriott has no revelance now that the actual trust documents for the DVC trust have been filed

ETA: Most up to date memorandum naming First Bank as trustee and seems to confirm that property has to be transferred to the trust in order to be sold and used by owners.

It’s why I said this discussion about PVB is really a side note as this is what makes me skeptical that that DVd could ever add inventory from sold out resorts to the trust…they don’t own enough of any unit to transfer it.

Last edited:

So, maybe we're misunderstanding each other. Each Notice of Addition will indicate the property added to the trust. It may specify units, etc. But it would be the functionally the same as if I had bought all of Poly Tower points myself. I may be deeded certain units, but I have access to all rooms at Poly.From my reading of the current rules and regulations, covenants and everything of the current trust DVC set up, yes, resort property has to be declared into the trust and then all or part of that resort property gets activated for use in the RTU plans, which then can be sold.

Edit: I think the only control DVC would need is to ensure the Trust owners don't exceed the number of points conveyed to the trust from Poly.

The Trust Agreement makes reference to "Notices of Addition," so my assumption is they will follow this practice.

Last edited:

- Joined

- Nov 15, 2008

- Messages

- 48,486

So, maybe we're misunderstanding each other. Each Notice of Addition will indicate the property added to the trust. It may specify units, etc. But it would be the functionally the same as if I had bought all of Poly Tower points myself. I may be deeded certain units, but I have access to all rooms at Poly.

So, DVC would need to implement controls to ensure the Trust doesn't infringe on non-Trust owners and vice-versa. It would be either by unit or by points, I would guess. I would think points would be most in-line with the spirit of the announcement since it would mean Trust and non-trust owners get access to all rooms. They would just be limited based on the total points for Poly Tower added to the Trust vs the legacy non-trust PVB.

The Trust Agreement makes reference to "Notices of Addition," so my assumption is they will follow this practice.

The documents explain that DVD adds property to the trust and then once added, DVD has to send notice to the trustees that they are activating some or all of the property to sell via the trust use pla, which lets the trustee know what they will be overseeing..

So, the trustees do not have authority to oversee any property that is not part of the trust…if PVB longhouses and bungalows are not part of the trust property, then none of the rules of the trust apply…

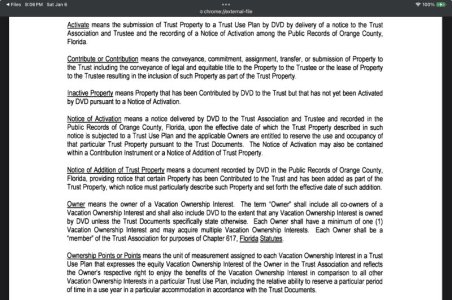

Here are more definitions from the documents. I guess I am confused because I can’t find anything in the documents that go with what you saying, so it would be great if you can point me to the correct spot, as I assume that you have read through it all.

But, here is the definition of what notice of addition means..I see nothing that allows the conveyance of “points” It only says that DVD will add property and that property must be defined..and that property will then create points that will be sold as part od the RTU plans.

Right now, those buying into the trust will only have the Cabins trust plan to buy, as thst is the only resort property that has been added…so they are the only ones who will get access to those cabins…but, once more property is added? Seems like they will get access to more.

ETA: there is also a clause..I posted it somewhere..that says only owners of the trust can have access to the trust property during what would be home resort booking periods.

Attachments

Last edited:

So, the trustees do not have authority to oversee any property that is not part of the trust…if PVB longhouses and bungalows are not part of the trust property, then none of the rules of the trust apply…

I guess this is the confusion. I see the Trust as becoming an ‘Owner’ in PVB. In fact, it will be majority owner on the board based on how many points will be in the trust from Poly Tower.

I would expect that DVC would convey the Poly Tower units to the Trust via a Notice of Addition. They would convert those units to points. Then convert those points to “Vacation Interests” (essentially a set increments of points, say 150 points) for sale.

The notice of addition may set out the trust rules for Poly. At least I’m attaching a recent example from Marriott where it looks like they the NOA added those rules.

If you’re reading something that would suggest DVC can’t do what Marriott is doing, that’s what I’m curious about? This NOA is from just a couple months ago.

Attachments

- Joined

- Nov 15, 2008

- Messages

- 48,486

I guess this is the confusion. I see the Trust as becoming an ‘Owner’ in PVB. In fact, it will be majority owner on the board based on how many points will be in the trust from Poly Tower.

I would expect that DVC would convey the Poly Tower units to the Trust via a Notice of Addition. They would convert those units to points. Then convert those points to “Vacation Interests” (essentially a set increments of points, say 150 points) for sale.

The notice of addition may set out the trust rules for Poly. At least I’m attaching a recent example from Marriott where it looks like they the NOA added those rules.

If you’re reading something that would suggest DVC can’t do what Marriott is doing, that’s what I’m curious about? This NOA is from just a couple months ago.

But the DVD trust can’t own or contain the units from the PVB longhouses or bungalows because DVD can’t convey them as they don’t own them. The only property that DVD can convey to it is the Poly tower. The trust is not like another owner,, it is an association that has property put in to it by DVD.

It even goes on to say that if property is added to the trust but not activated for use, only DVD can use them…but they then become completely responsible for the inactive parts of the property.

And, if the units were to be added to PVB under a different vacation plan…which is what they’d hsve to do to make them even part of PVB, and the trust, I just don’t know that the rules of each plan has to be the same…

I am looking at this from the terms of the trust DVD created. and not PVB…it says any property part of the trust must be defined when added and only owners of the trust can access trust property.

Since current PVB units can’t be put into the trust, then I don’t see how they get access to trust property.

As I said, since the documents are now filed, can you show me where you read in the DVC trust agreement that DVD can do what you are explaining?

ETA: the terms of the Marriott plan are not part of the way DVD, as the settlor, set up the trust…so, they don’t appear to be doing it that way.

Could DVD have copied that? Probably …but it doesn’t seem like they did. We know how they want their trust to function…what we don’t know is what property and trust use plan will come next.

But, we do have a glimpse with how they added the cabins and set up that plan.

Last edited:

aka Charles

Mouseketeer

- Joined

- Mar 14, 2022

- Messages

- 356

This may have been answered already, as I am still trying to catch up on all of today's discussions...

Is it possible that the restrictions could be attached to the TRUST contracts purchased, but not the DEEDED points/units that the Trust owns?

If the poly tower is put into the same association as PV1 and the trust "purchases" some or all of the declared units in the tower, I could see where the trust, itself, may not have restrictions in the association under the PVB POS, but they could add restrictions on the contracts they sell for "membership" in the trust.

It could be like a contract to rent out points, aka RTU. (for 50 years, lol)

Would they have to create separate booking categories for units under control of the trust?

.

The fact it gave CFW restrictions still gives me pause as to why they would not get them on the Poly tower if they have a way to do it.

Is it possible that the restrictions could be attached to the TRUST contracts purchased, but not the DEEDED points/units that the Trust owns?

If the poly tower is put into the same association as PV1 and the trust "purchases" some or all of the declared units in the tower, I could see where the trust, itself, may not have restrictions in the association under the PVB POS, but they could add restrictions on the contracts they sell for "membership" in the trust.

It could be like a contract to rent out points, aka RTU. (for 50 years, lol)

I do not think the trust owners can be given 11 month booking at PVB because they are not owners of PVB.

Current PVB owners who have a deeded interest in the actual property are guaranteed the the only ones who can book those rooms declared now are actual owners. So, thst leaves trust beneficiaries out.

The only way PVB owners would have a guaranteed right to the Poly tower rooms is if they are declared as new to PVB via the same vacation plan that currently exists.

Any units activated into the trust are subject to the trust POS and that resort properties RTU plan.

So, that’s where it gets tricky. As I continue to read, I am leaning more now. The reason is that if trust beneficiaries can’t book PVB rooms since they are not owners, then allowing PVB owners booking access during home resort creates a greater than 1:1 point to inventory ratio for the trust owned property.

Thst is why IF they decide to surprise everyone and incorporate the Poly tower units under the trust, I have to believe they will keep it as clean as possible.

As I have said, let’s really hope we get some documents for the tower in the next few months!

Would they have to create separate booking categories for units under control of the trust?

.

- Joined

- Nov 15, 2008

- Messages

- 48,486

The trust can’t buy anything. DVD gives the trust its property either as a lease or title. Thats it.This may have been answered already, as I am still trying to catch up on all of today's discussions...

Is it possible that the restrictions could be attached to the TRUST contracts purchased, but not the DEEDED points/units that the Trust owns?

If the poly tower is put into the same association as PV1 and the trust "purchases" some or all of the declared units in the tower, I could see where the trust, itself, may not have restrictions in the association under the PVB POS, but they could add restrictions on the contracts they sell for "membership" in the trust.

It could be like a contract to rent out points, aka RTU. (for 50 years, lol)

Would they have to create separate booking categories for units under control of the trust?

.

DVD then decides when to activate that property as part of a plan to sell RTU interests. And then DVD creates the trust use plan that they will sell to owners.

The restrictions can be put on the trust property because the trust property so far, CFW, entered BVTC with the same rules as VDH and RIV.

If DVD adds the tower units to PVB con association as part of their current vacation plan, those units would become part of the leasehold condo and sold as the rest of PVB was sold.

The only way DVD can add them to PVB and then sell them as a RTU plan is to create a brand new vacation plan that is written like that…the question really is then, if they do that, can they turn over control of those units to the trust if they want, since they remain the owner of those points and thus never declare them for use under the current PVB leasehold condo plan?

If you read the current resort POS, including PVB, it does say it can add things to a resort and never sell them…

But, the more I even go through things and read the trust snd the POS of my home resorts and PVB, the more I realize it would make little sense to even do it and risk issues from owners..

I think I am now at the point that it will be one or the other…it will become part of PVB and sold as a leasehold condo property, or it will be added to the current trust that was created and have its own plan, similar to the Cabins plan, and sold only that way.

-

Disney Character Meals Are Not Automatically Worth the Price

-

Route Update for Disney Starlight Parade at Magic Kingdom

-

Disney Dream Adds Railing After Overboard Incident

-

Cool KIDS' SUMMER Resorts Change for Disney World in 2026

-

What is Marvel Day at Sea Aboard Disney Cruise Line?

-

Hollywood Brown Derby Unveils Fresh Spring Menu at Disney World

-

New Walt Disney Archives Display in Carthay Circle at Disneyland

New Threads

- Replies

- 0

- Views

- 1

- Replies

- 0

- Views

- 169

- Replies

- 28

- Views

- 963

- Replies

- 2

- Views

- 440

New Posts

- Replies

- 126

- Views

- 19K

- Replies

- 0

- Views

- 1

- Replies

- 88

- Views

- 33K

- Replies

- 580

- Views

- 83K

- Replies

- 13

- Views

- 2K

- Replies

- 5K

- Views

- 781K

Resort Thread

Walt Disney World SWAN, DOLPHIN & SWAN RESERVE Resorts

- Replies

- 24K

- Views

- 3M

- Replies

- 28

- Views

- 963