cbyrne1174

Mouseketeer

- Joined

- Sep 1, 2018

- Messages

- 218

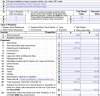

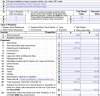

Has anyone on here ever filled in a 1040 Schedule E for DVC rentals on here? I figured out how to fill it in pretty easily for my Wyndham profit because it had an insignificant purchase price. I only paid a few hundred bucks for an ownership that has no expiration. DVC is trickier however because I want to learn how to write off my $4.77 cost per point per year purchase price since DVC actually has an expiration. I'm only renting out 13 points this year. I put my annual dues under maintenance (line 7) as $6.03 per point (SSR), my taxes (line 16) as $1.30 per point and my purchase price under line 18 (depletion) as $4.77 per point. Is there another place I put this as an expense or does it go under line 18?

BTW everyone on here doing rentals is going to have to do this next year because of the law that passed last year.

BTW everyone on here doing rentals is going to have to do this next year because of the law that passed last year.

Last edited: