You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DUES Info! - All resorts dues have been released

- Thread starter VGCgroupie

- Start date

VGCgroupie

Im in this photo

- Joined

- May 29, 2017

- Messages

- 11,449

Im not a POS master reader but I dont think a cap on dues is a thing.I wonder if there will ever be a cap or am I going to be paying $15 per point in 12 years. Eventually the value of the contracts will tank a lot of it costs way too much for dues

eticketplease

DIS Veteran

- Joined

- Aug 24, 2021

- Messages

- 6,641

Just be pleased if you get 12 years.I wonder if there will ever be a cap or am I going to be paying $15 per point in 12 years. Eventually the value of the contracts will tank a lot of it costs way too much for dues

in one more year, 2027, VB will be at that mark

airjay75

DIS Veteran

- Joined

- Apr 21, 2025

- Messages

- 1,512

So long as dues are less than Disney's rack rates, there will always be value in the contract. And, the good news is that cash rates at Disney tend to go up at a rate that equals or exceeds the rate of inflation. So, dues may be $15/point in 12 years, but Disney's rack rate may go from $25/point to $30/point. When you think about the effect of inflation on today's dollars, it always feels somewhat awkward to think about the fact that something that costs $X today will cost $Y in so many years. For example, even if you just assume a modest 3% inflation rate, something that costs $10 today should cost $14.26 in 12 years.I wonder if there will ever be a cap or am I going to be paying $15 per point in 12 years. Eventually the value of the contracts will tank a lot of it costs way too much for dues

I just pulled up a basic inflation calculator - https://www.calculator.net/inflation-calculator.html. It's a fun exercise to put in the dues for a given resort and see what the dues of that resort should be if it had just tracked inflation. A few examples.

RIV opened in December 2019 with annual dues of $8.31. If that had kept pace with inflation, dues today should be $10.46. Actual dues starting in January will only be $9.46.

CCV opened in July 2017 with annual dues of $7.33. If that had kept pace with inflation, dues today should be $9.73. Actual dues starting in January will only be $9.02

BLT opened in August 2009 with annual dues of $3.67. Here, the growth in dues have exceeded inflation - had it tracked inflation, dues would only be $5.52. Actual dues starting in January will be $8.74.

SSR opened in May 2004 with annual dues of $3.80. Growth has also exceeded inflation here - had it tracked inflation, dues would only be $6.53. Actual dues starting in January will be $9.19.

VGF opened in October 2013 with annual dues of $5.41. If dues had tracked inflation, they should be $7.52. Actual dues starting in January will be $8.31.

Just a few examples.

Chili327

On the Boardwalk…

- Joined

- Feb 18, 2023

- Messages

- 5,139

Still seems to be CCV, and BLT is getting to be up to the point it’s not in the club anymore. lolSo. Now that we have updated numbers, what is the best SAP/SAP+?

Maybe I should be focusing on CCV instead of BWV. lolWell as I am adding up my dues. I thought BWV was better for me % wise. But CCV was the winner for me when you look at just overall cents more per point. Loving my CCV more and more. And to think CCV was my very first newbie contract. Too bad it's only 100 points.

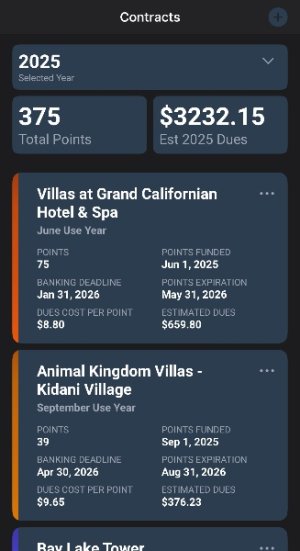

Does anyone else use this to see what their dues will be? “D\/C Toolkit”I calculate my total at about $8500 for 2026.

tx911

Hate the politics, love the voter

- Joined

- Jul 28, 2023

- Messages

- 3,136

.

I use that. I'm not sure it's 100% accurate though. Just an estimate maybe?Still seems to be CCV, and BLT is getting to be up to the point it’s not in the club anymore. lol

Maybe I should be focusing on CCV instead of BWV. lol

Does anyone else use this to see what their dues will be? “DVC Toolkit”

View attachment 1026449

Chili327

On the Boardwalk…

- Joined

- Feb 18, 2023

- Messages

- 5,139

True, I’m not sure how accurate, but it’s nice to see what it might be if I add this contract with that many points or that contract with this many points, etc.I use that. I'm not sure it's 100% accurate though. Just an estimate maybe?

I’ll check it when my dues actually hit my membership.

VGCgroupie

Im in this photo

- Joined

- May 29, 2017

- Messages

- 11,449

Well geez. I used it, and didn’t double check it..

I use that. I'm not sure it's 100% accurate though. Just an estimate maybe?

airjay75

DIS Veteran

- Joined

- Apr 21, 2025

- Messages

- 1,512

TBH, BLT perplexes me somewhat. The dues are still low, but even before this year's large increase, their compounded annual growth rate was 5% - https://www.dvcresalemarket.com/buying/annual-dues/. So, not only does BLT have one of the highest CAGRs, it is the resort with the highest percentage increase this year - it's CAGR is going to exceed VB once you factor in this year's increase.Still seems to be CCV, and BLT is getting to be up to the point it’s not in the club anymore. lol

And, when I think about BLT, I just don't really get it. What drives the increase in dues here that is higher than average? Is there something unique about its sharing of expenses with the CR vs. VGF and PVB? Were dues originally just really underestimated, and so we've got years of playing catch up? I realize some of this year's increase is on account of the recent hard good refurb, but we've got many years of data now with increases in dues on the high end of things (in percentage terms).

And I say this as someone who really likes BLT and very nearly bought a good number of BLT points a few months ago (but am sort of really glad I've ended up with CCV instead

tx911

Hate the politics, love the voter

- Joined

- Jul 28, 2023

- Messages

- 3,136

Is the 2025 estimate for the upcoming dues or the ones we already paid?True, I’m not sure how accurate, but it’s nice to see what it might be if I add this contract with that many points or that contract with this many points, etc.

I’ll check it when my dues actually hit my membership.

Add-On-Itis

Mouseketeer

- Joined

- Oct 19, 2025

- Messages

- 139

That would make VGF and PVB good SAP pointsYea the higher points equal lower dues argument is a little silly, sure your per point is lower but you gotta spend more points to stay there so it's kinda a wash vs slightly higher dues per point but less points per stay.

Now having lower dues and staying at a cheaper resort, that makes sense.

VGCgroupie

Im in this photo

- Joined

- May 29, 2017

- Messages

- 11,449

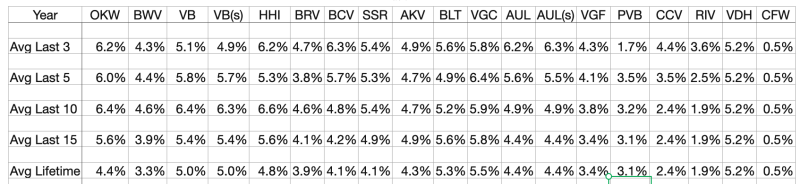

So we calculated the estimated average increase over the life. Ugh why is it blurry. Blah! I will type it out in an edit.

OKW - 4.4%

BWV - 3.3%

VB - 5%

HHI - 4.8%

BRV - 3.9%

BCV - 4.1%

SSR - 4.1%

AKV - 4.3%

BLT - 5.3%

VGC - 5.5%

AUL - 4.4%

VGF - 3.4%

POLY - 3.1%

CCV - 2.4%

RIV - 1.9%

VDH - 5.2%

CFW - 0.5%

OKW - 4.4%

BWV - 3.3%

VB - 5%

HHI - 4.8%

BRV - 3.9%

BCV - 4.1%

SSR - 4.1%

AKV - 4.3%

BLT - 5.3%

VGC - 5.5%

AUL - 4.4%

VGF - 3.4%

POLY - 3.1%

CCV - 2.4%

RIV - 1.9%

VDH - 5.2%

CFW - 0.5%

Attachments

Last edited:

VGCgroupie

Im in this photo

- Joined

- May 29, 2017

- Messages

- 11,449

So we calculated the estimated average increase over the life. Ugh why is it blurry. Blah! I will type it out in an edit.

OKW - 4.4%

BWV - 3.3%

VB - 5%

HHI - 4.8%

BRV - 3.9%

BCV - 4.1%

SSR - 4.1%

AKV - 4.3%

BLT - 5.3%

VGC - 5.5%

AUL - 4.4%

VGF - 3.4%

POLY - 3.1%

CCV - 2.4%

RIV - 1.9%

VDH - 5.2%

CFW - 0.5%

Standout to me is the high % for VDH in its short lifespan vs RIV and CFW. Also if you see VGC its the highest % so this does not give me the good feels for where VDH is headed...

VGCgroupie

Im in this photo

- Joined

- May 29, 2017

- Messages

- 11,449

TBH, BLT perplexes me somewhat. The dues are still low, but even before this year's large increase, their compounded annual growth rate was 5% - https://www.dvcresalemarket.com/buying/annual-dues/. So, not only does BLT have one of the highest CAGRs, it is the resort with the highest percentage increase this year - it's CAGR is going to exceed VB once you factor in this year's increase.

And, when I think about BLT, I just don't really get it. What drives the increase in dues here that is higher than average? Is there something unique about its sharing of expenses with the CR vs. VGF and PVB? Were dues originally just really underestimated, and so we've got years of playing catch up? I realize some of this year's increase is on account of the recent hard good refurb, but we've got many years of data now with increases in dues on the high end of things (in percentage terms).

And I say this as someone who really likes BLT and very nearly bought a good number of BLT points a few months ago (but am sort of really glad I've ended up with CCV instead).

When I was deciding on my first contract, I looked at BLT average increase and commented on it here. People did not agree with me since it still had lower overall dues. I ended up going CCV as you know.

Last edited:

VGCgroupie

Im in this photo

- Joined

- May 29, 2017

- Messages

- 11,449

Another breakdown coming soon!!

atthebeachclub

DIS Veteran

- Joined

- Apr 18, 2024

- Messages

- 2,096

I suspect California wages and cost of living explain a lot. And having major fires in Southern California probably didn’t help insurance rates.Standout to me is the high % for VDH in its short lifespan vs RIV and CFW. Also if you see VGC its the highest % so this does not give me the good feels for where VDH is headed...

VGCgroupie

Im in this photo

- Joined

- May 29, 2017

- Messages

- 11,449

airjay75

DIS Veteran

- Joined

- Apr 21, 2025

- Messages

- 1,512

Thank you for this! Amazing!So we calculated the estimated average increase over the life. Ugh why is it blurry. Blah! I will type it out in an edit.

OKW - 4.4%

BWV - 3.3%

VB - 5%

HHI - 4.8%

BRV - 3.9%

BCV - 4.1%

SSR - 4.1%

AKV - 4.3%

BLT - 5.3%

VGC - 5.5%

AUL - 4.4%

VGF - 3.4%

POLY - 3.1%

CCV - 2.4%

RIV - 1.9%

VDH - 5.2%

CFW - 0.5%

Yeah, BLT continues to perplex me. Its average growth rate is surpassed only by VGC. And, at least in my mind, I tend to put WDW resorts in a different category than VDH/VGC vs. AUL vs. HHI/VB. But, the fact that BLT is surpassing all of them other than VGC, I just don't really get it. And, at this point, you have to look at BLT's average annual increase and consider it a significant downside to BLT. What exactly is it that causes it to consistently have one of the highest increases in dues in percentage terms?When I was deciding on my first contract, I looked at BLT average increase and commented on it here. People did not agree with me since it still had lower overall dues. I ended up going CCV was you know.

(And, I feel your pain on VDH - it's easy for us folks not very interested in DLR resorts to sort of look past it, but I wouldn't be getting good feels right now either.)

More Amazing! Thank you!

Last edited:

eticketplease

DIS Veteran

- Joined

- Aug 24, 2021

- Messages

- 6,641

Wow, so if I took out a mortgage to pay my dues, I’d come out way ahead with CFWSo we calculated the estimated average increase over the life. Ugh why is it blurry. Blah! I will type it out in an edit.

OKW - 4.4%

BWV - 3.3%

VB - 5%

HHI - 4.8%

BRV - 3.9%

BCV - 4.1%

SSR - 4.1%

AKV - 4.3%

BLT - 5.3%

VGC - 5.5%

AUL - 4.4%

VGF - 3.4%

POLY - 3.1%

CCV - 2.4%

RIV - 1.9%

VDH - 5.2%

CFW - 0.5%

eticketplease

DIS Veteran

- Joined

- Aug 24, 2021

- Messages

- 6,641

Don’t forget VGC also has $.50 or so included in the dues for the transient taxBut, the fact that BLT is surpassing all of them other than VGC, I just don't really get it.

-

Disney Cruise Line Cancels Sunday's Castaway Cay Stop Due to Weather

-

Legendary Actress Catherine O'Hara Has Died at 71

-

Disney California Adventure 25th Anniversary Details Revealed

-

What Disney World Rides Are CLOSED in February 2026?

-

Celebrate Soulfully Returns to Disney Parks for Black History Month 2026

-

NEW Zootopia Passholder Perks at Disney's Animal Kingdom

-

We Are Drooling Over New Valentine's Treats at Disney Parks!

New Threads

- Replies

- 6

- Views

- 341

- Replies

- 10

- Views

- 429

- Replies

- 3

- Views

- 318

- Replies

- 0

- Views

- 196

New Posts

- Replies

- 2K

- Views

- 271K

- Replies

- 71

- Views

- 8K

- Replies

- 2K

- Views

- 254K

- Replies

- 10

- Views

- 429

- Replies

- 59

- Views

- 4K

- Replies

- 17

- Views

- 1K