Please update us if you get any further info. This could make or break future sales.

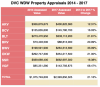

I ran across this info when buying last October. I'm a little concerned, but then looking at the property tax portion of dues on BWV (where I purchased), over the last 10 years the amount going toward the taxes has gone up by about 50% but really that amounts to about $.50/pt.....over 10 years. Kind of puts it in perspective.

Now, I'm too lazy to go looking up actual #s right this minute, but I think the current tax portion of our dues is around $1.50 and I believe there is a cap on annual tax increases of 10% annually. So, at worst, the prop tax portion of dues could go up $.15 next year. Yeah, I get it....it will eventually add up but I'm not going to panic.

I do cringe though when I see people buying home resorts (ex: SSR and BLT) in part because of their low dues and wonder why people believe those resorts will always stay at the low end. Is there a cap on what

DVC can raise dues? I don't think so. Then I think about CCV and believe that property would not likely be affected by a reassessment because it should already be pretty "accurate", right? Also, it's new, so there shouldn't be a lot of "surprise maintenance" etc. So, will all the other resorts start to catch up to CCV in dues?

I don't know. It will just be really interesting to see how all the dues "rank" 10 years from now. I have no actual knowledge on this stuff. Just curious to watch and see what happens. I think I saw that BWV dues used to be a lot more than OKW and also more than BRV and now OKW and BRV are more than BWV. And I think the gap between BWV and BCV is smaller than it used to be as well......

Bill

Bill

Thanks! That was kind. And I did some digging and saw that in many respects, FL does have much lower taxes than say, IL and the Northeast for example. We are self-employed and taxes absolutely eat our lunch. And a lot of our breakfast too!

Thanks! That was kind. And I did some digging and saw that in many respects, FL does have much lower taxes than say, IL and the Northeast for example. We are self-employed and taxes absolutely eat our lunch. And a lot of our breakfast too!