https://www.the-numbers.com/movie/Deadpool-and-Wolverine-(2024)#tab=box-office

Deadpool 3: $205m estimated opening. $438m worldwide.

Inside Out pushing toward $1.5b worldwide

Kingdom of the Planet of the Apes crawling towards $400m in limited theatres, ahead of its Hulu release date.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

DIS Shareholders and Stock Info ONLY

- Thread starter hhisc16

- Start date

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 7,096

DIS' press release.

https://thewaltdisneycompany.com/deadpool-and-wolvering-box-office/

July 28, 2024

‘Deadpool & Wolverine’ Breaks Box Office Records with Largest R-rated Global Opening Ever

https://thewaltdisneycompany.com/deadpool-and-wolvering-box-office/

July 28, 2024

‘Deadpool & Wolverine’ Breaks Box Office Records with Largest R-rated Global Opening Ever

Unfortunately, these two gigantic hits from a studio thought dead, has done nothing for the stock - it's exactly where it was a year ago, in the high 80's. Will we see something to the upside on Monday?what a difference one year makes!

clarker99

DIS Veteran

- Joined

- May 15, 2019

- Messages

- 1,201

only positive is that $DIS dividend hit my account on Friday.Unfortunately, these two gigantic hits from a studio thought dead, has done nothing for the stock - it's exactly where it was a year ago, in the high 80's. Will we see something to the upside on Monday?

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 7,096

clarker99

DIS Veteran

- Joined

- May 15, 2019

- Messages

- 1,201

Honestly, I am just hoping the computer algorithms start buying. Lol.Unfortunately, these two gigantic hits from a studio thought dead, has done nothing for the stock - it's exactly where it was a year ago, in the high 80's. Will we see something to the upside on Monday?

We know the KPI’s are good. With the studios turned around (hopefully) the only thing declining is Linear.

The catalyst is DTC and we have been told over and over that any sustained and meaningful profits should start in Q4.

D23 is 2 days after the call.

In 2.5 weeks we should have a lot to talk about. And if I know these boards, it will all be rational. Lol.

Get your popcorn ready!And if I know these boards, it will all be rational. Lol.

For the life of me I don't understand why the stock isn't trading around $120 or so right now.... So many things have improved, streaming is profitable, movies are making big dollars...

I feel like DIS is being lumped in with companies like Paramount/WBD that are truly and utter failures...

Or maybe the street feels that Netflix is the dominant player and it is all over. I haven't had a Netflix account since 2017 or so... Don't miss it one bit, but have all three Disney products...

That said, linear will continue to decline, and needs to reinvent itself. Comcast has definitely exceeded at this - they understand they are in an existential crisis and are clearly doing a "throw everything at the wall" approach with streaming right now...

I feel like DIS is being lumped in with companies like Paramount/WBD that are truly and utter failures...

Or maybe the street feels that Netflix is the dominant player and it is all over. I haven't had a Netflix account since 2017 or so... Don't miss it one bit, but have all three Disney products...

That said, linear will continue to decline, and needs to reinvent itself. Comcast has definitely exceeded at this - they understand they are in an existential crisis and are clearly doing a "throw everything at the wall" approach with streaming right now...

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 7,096

https://finance.yahoo.com/quote/DIS/

The Walt Disney Company (DIS)

92.53 +2.60 (+2.89%)

As of 1:18 PM EDT. Market Open.

The Walt Disney Company (DIS)

92.53 +2.60 (+2.89%)

As of 1:18 PM EDT. Market Open.

clarker99

DIS Veteran

- Joined

- May 15, 2019

- Messages

- 1,201

https://finance.yahoo.com/quote/DIS/

The Walt Disney Company (DIS)

92.53 +2.60 (+2.89%)

As of 1:18 PM EDT. Market Open.

The computer algorithms have awoken. Lol.Honestly, I am just hoping the computer algorithms start buying. Lol.

HokieRaven5

DIS Veteran

- Joined

- Mar 5, 2020

- Messages

- 8,257

Updated Domestic Opening weekend at $211.4M.‘Deadpool and Wolverine’ snares $205 million domestic opening, highest R-rated debut ever

https://www.cnbc.com/2024/07/28/deadpool-and-wolverine-box-office-opening-tops-205-million.html

https://www.the-numbers.com/movie/Deadpool-and-Wolverine-(2024)#tab=box-office

wabbott

DIS Veteran

- Joined

- Aug 4, 2021

- Messages

- 7,096

https://www.yahoo.com/news/disneyland-workers-ratify-contract-averted-132924272.html

Disneyland workers ratify contract that averted strike

by Christi Carras

Tue, July 30, 2024 at 8:29 AM CDT

According to the Master Services Council, the three-year agreements contain pay increases amounting to $6.10 an hour over the life of the contract, a higher minimum wage of $24 an hour in 2024, additional compensation bumps for senior employees and a more flexible attendance policy for custodians, ride operators, candy makers, merchandise clerks and other workers who keep Disneyland running.

Disneyland workers ratify contract that averted strike

by Christi Carras

Tue, July 30, 2024 at 8:29 AM CDT

According to the Master Services Council, the three-year agreements contain pay increases amounting to $6.10 an hour over the life of the contract, a higher minimum wage of $24 an hour in 2024, additional compensation bumps for senior employees and a more flexible attendance policy for custodians, ride operators, candy makers, merchandise clerks and other workers who keep Disneyland running.

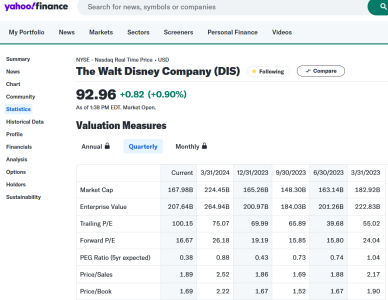

From a quick glance, the P/E Ratio of over 100 is pretty glaring. When they get earnings back under control the price should rise a little bit, but Disney should not be priced as a “growth/tech” stock since they’re a mature company. Sure a pivot to streaming should help the tech side of the company grow, but that is to offset the cable and theater side of the business.For the life of me I don't understand why the stock isn't trading around $120 or so right now.... So many things have improved, streaming is profitable, movies are making big dollars...

Given the earnings issues they have worked thru over the last year or so, probably makes more sense to look at the forward PE - a pretty dang reasonable 17 and pretty close to their pre-pandemic average. I guess the question is how much of a better company are they today vs. back then? Steaming, much better with a solid #2 position and study profitability on the way, parks and cruise are still holding study and always seem able to increase per quest spending but are those enough to overcome liniers decline and increased sports rights costs and a possible travel slowdown? And does profitable streaming earn the stock Netflix type multiples (which is what drove it to $200 for a time)?From a quick glance, the P/E Ratio of over 100 is pretty glaring. When they get earnings back under control the price should rise a little bit, but Disney should not be priced as a “growth/tech” stock since they’re a mature company. Sure a pivot to streaming should help the tech side of the company grow, but that is to offset the cable and theater side of the business.

clarker99

DIS Veteran

- Joined

- May 15, 2019

- Messages

- 1,201

Need to look at Fwd PE. The stock price pre-Covid was $150ish. They are on pace to produce cash flows at or above pre-pandemic levels in FY24. There is really no good reason why it is sitting in the low $90's given profits and cash flow guidance.From a quick glance, the P/E Ratio of over 100 is pretty glaring. When they get earnings back under control the price should rise a little bit, but Disney should not be priced as a “growth/tech” stock since they’re a mature company. Sure a pivot to streaming should help the tech side of the company grow, but that is to offset the cable and theater side of the business.

Thanks Clarker99, I forgot to mention cash flow. And they are exceeding pre-pandemic FCF with dividends and buy backs back in place and lets not forget $60B in Experience investments.Need to look at Fwd PE. The stock price pre-Covid was $150ish. They are on pace to produce cash flows at or above pre-pandemic levels in FY24. There is really no good reason why it is sitting in the low $90's given profits and cash flow guidance.

Last edited:

Not sure if I'd trust Disney's forward P/E guidance until we see actual performance to back it up - Disney+ has been a money sink and there's still a significant risk of faster cord cutting harming earnings faster than Disney+/Hulu/ESPN+ growing profitability.Need to look at Fwd PE. The stock price pre-Covid was $150ish. They are on pace to produce cash flows at or above pre-pandemic levels in FY24. There is really no good reason why it is sitting in the low $90's given profits and cash flow guidance.

I think the $60B investment might be dragging down the stock valuation for the time being until some return is seen on it. Right now that's a $60 billion liability on the balance sheet. When/if park visitor spending goes up after the investment starts, numbers will be a little more solid and investors might give Disney the benefit of the doubt.Thanks Clarker99, I forgot to mention cash flow. And they are exceeding pre-pandemic FCF with dividends and buy backs back in place and lets not forget $60B in Experience investments.

The problem with the stock is that every part of Disney's business has questions and uncertainties about the future.Not sure if I'd trust Disney's forward P/E guidance until we see actual performance to back it up - Disney+ has been a money sink and there's still a significant risk of faster cord cutting harming earnings faster than Disney+/Hulu/ESPN+ growing profitability.

I think the $60B investment might be dragging down the stock valuation for the time being until some return is seen on it. Right now that's a $60 billion liability on the balance sheet. When/if park visitor spending goes up after the investment starts, numbers will be a little more solid and investors might give Disney the benefit of the doubt.

Linear - this has been getting scrutinized for years as it has been shrinking with no real stabilization happening.

Parks - Extremely soft summer reported by Universal and more competition coming with Epic Universe opening next year.

Streaming - Probably the one segment with the least questions at the moment but still, can Disney increase ARPU enough as it pales in comparison to Netflix. As Netflix stops reported some key metrics about subscribers, will Disney follow suit.

The company is doing much better free cash and profit wise compared to the previous few years but it stands to reason, how high can it go. The investments in the parks should, in theory, should help keep that segment in a growth trajectory and as an investor, the $60B stated investment would not be seen as a liability nor hurt the stock. Plus, the $60B is not even a liability, they can choose not to invest anything at all if they want to.

Streaming is at a key point as this should become a consistent growth driver for both revenue and profits from this point on. This will become the largest part of Disney's financials, certainly in terms of revenue and one would hope, profits as well. This segment can help mitigate a lot of park fears anytime a story might come out about soft attendance.

-

New Shaken & Stirred Classes + Whiskey & Wonder Event

-

New Shanghai Disney Celebration + Hong Kong Duffy Treats!

-

Need to Rent a Stroller, ECV, or Wheelchair While at Disney World? Save 10%!

-

Being Called a 'Disney Adult' Is Not the Insult You Think It Is

-

Are the New Upgrades Enough to Save Hollywood Studios?

-

Disney & Formula 1 'Fuel the Magic' for New 2026 Race Season

-

Disney x BAGGU Debut Mickey & Friends Bag Collection

New Threads

- Replies

- 5

- Views

- 127

- Replies

- 0

- Views

- 73

Disney Vacation Planning. Free. Done for You.

Our Authorized Disney Vacation Planners are here to provide personalized, expert advice, answer every question, and uncover the best discounts.

Let Dreams Unlimited Travel take care of all the details, so you can sit back, relax, and enjoy a stress-free vacation.

Start Your Disney Vacation

New Posts

- Replies

- 2K

- Views

- 122K

- Replies

- 1K

- Views

- 193K

- Replies

- 9K

- Views

- 274K

- Replies

- 11K

- Views

- 292K

- Replies

- 20

- Views

- 2K

- Replies

- 6

- Views

- 1K

- Replies

- 47

- Views

- 11K

- Replies

- 8K

- Views

- 959K