These types of changes are pretty bad...

It's enough that I have the $25 monthly dining credit on the Bonvoy Brilliant card I need to remember to use, and the $15/month Platinum Amex Uber credit (that I use on Eats), now I'd get another 40+ "coupons" I need to use every year to try and recover the new exorbitant fee?

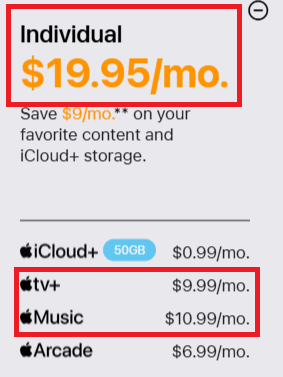

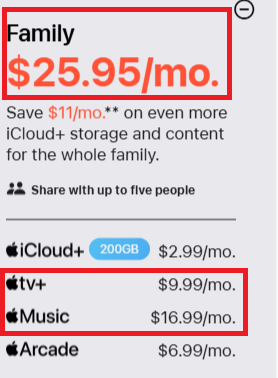

If the intent was benevolent, they would give you a $120 annual Lyft credit that even the occasional user may use on rides when they travel 2-3 times a year. Or an annual $300 DoorDash credit that you can use to order 4-6 times a year and not be out of pocket on each order. And how many people get just Apple TV+ and Apple Music, but not the Apple One bundle (to which the credit would presumably not apply)? Here's the Apple One cost for an individual/family vs the itemized cost of TV+ and Music.

Since most people would go with the bundle price (that also includes arcade and extra storage for less money), those people couldn't use the $250 Apple credits...

This was the "problem" from their perspective with the $300 travel credit that was probably used close to 100%. The intent here is totally to get you to not use the credits by making them attractive on paper ($2000+!!!) but difficult to monetize.

... I guess the

... I guess the