Hmmm. As I think about this a little more, I think you probably have to compare to what there was last year because, presumably, there is a debit or credit each year.

2024:

https://dvcnews.com/dvc-program-men...-for-most-walt-disney-world-based-dvc-resorts

2025:

https://dvcnews.com/dvc-program-men...l-tax-rates-for-walt-disney-world-dvc-resorts

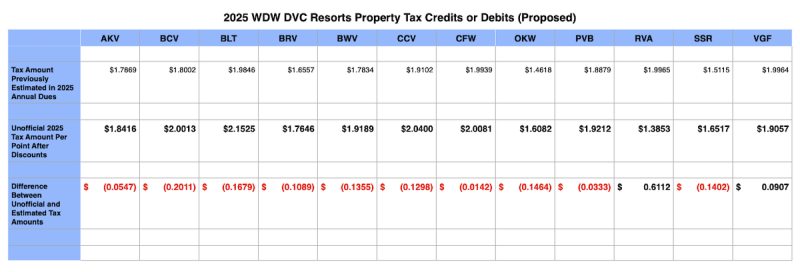

Both RIV and VGF, interestingly, had credits last year too - and those credits presumably brought down the estimated taxes for 2025.

So, let's take RIV as an example. The 2024 taxes actually owed resulted in a $0.40/point credit. Then, the estimated tax bill that went out for 2025 was $1.99/point. That bill, presumably reflected what DVD expected the tax bill in 2025 to be minus the $0.40/credit for overpayment on the 2024 taxes. Without that credit, it means DVD was estimating the 2025 tax bill to be about $2.39/point ($1.99+$0.40)

Now, DVD needs to calculate what the 2026 estimated tax bill will be. They probably have some formulas they use to do that - then, they have to either add the debit or take away the credit. So, for 2026 at RIV, you'll get about a $0.61/point credit. Because that is greater than last year's credit, assuming everything else in your dues were to remain equal, I think that would translate into about a $0.21/point reduction in RIV's dues. But, again, that were to assume that everything else - estimated taxes, operating, and reserves stayed constant year over year - and I imagine they will not. Still, it should help rather than hurt any growth in dues for RIV.

For any other resort, I think you probably need to look at the last year's credit/debit vs. this years. So, VGF's credit last year was actually about $0.18/point, while this year, it is $0.09/point. That means it will be getting less of a credit this year than it did last year, which means (holding everything else constant) dues would rise by the difference. So that will hurt rather than help any growth in dues for VGF.

Every other resort had debits each year and, there, you'd need to do the reverse calculation - if the debit last year was greater than the debit this year, it will help keep your dues lower this year and vice versa.

I think I'm looking at this right, but feel free to tell me I'm looking at this all wrong since I'm pretty new to this.