You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2023 DVC Dues:

- Thread starter havoc315

- Start date

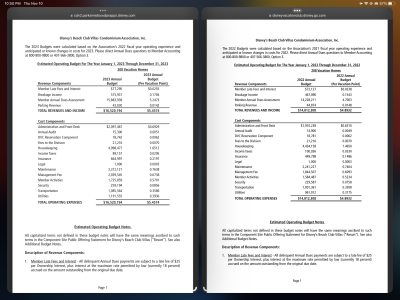

None of those things are particularly reflected in the dues increases. Of the $.5916 total increase for 2023, only about five cents is going toward higher property taxes and another five cents for capital improvements.PVB has had many improvement projects over the last few years (new monorail station, soft goods refurb moved up, Kona remodel, etc), so no surprise there. It still remains one of the better values.

The remaining $.4739 is all for higher day-to-day operating costs. The big culprit is housekeeping which rose $.2094 per point. Insurance is up by seven cents. Transportation is up almost six cents. The rest is a few pennies here and there for security, member actives, management fee, etc.

peabody58

I'm just a drummer in a R&R Band!!

- Joined

- Mar 28, 2010

- Messages

- 1,405

First of all, thank you for the post and data. 2 more line items for my 2023 budget are updated and are below estimated.WDW resorts, dues rankings are now:

The dues ranking is all in all good to know, but a DVC member should also consider point chart for villa stays. While my BWV dues are in the top third, the points per night are almost the cheapest for standard villas. Hence, not accounting for buy-in costs (which were emotional high), my stays at BWV are significantly cheaper than other resorts with lower dues cost.

My BLT points continue to be the best bang for my buck, especially when factoring in my 2010 buy-in costs.

As always, YMMV.

First of all, thank you for the post and data. 2 more line items for my 2023 budget are updated and are below estimated.

The dues ranking is all in all good to know, but a DVC member should also consider point chart for villa stays. While my BWV dues are in the top third, the points per night are almost the cheapest for standard villas. Hence, not accounting for buy-in costs (which were emotional high), my stays at BWV are significantly cheaper than other resorts with lower dues cost.

My BLT points continue to be the best bang for my buck, especially when factoring in my 2010 buy-in costs.

As always, YMMV.

Actually, for someone buying now, stays at BWV would be far far more expensive than the resorts with lower dues, but that's because of residual value.

But accounting for "point chart" only means, "the resort is cheaper." The best "point chart" is to stay off property or a value resort.

But anyway.... Removing the massive effect of residual value, and only looking at out of pocket costs:

Staying tonight at Grand Floridian is 19 points for a studio.

Staying tonight in a standard studio at BWV -- 13 points.

So total dues, just to stay in a studio tonight at either GF or BWV, assuming you're buying the exact number of points you need for the same stay:

$139 in Dues for GFV and $111 in dues for BWV.

So yes, the dues end up being slightly cheaper at BWV, if you're only buying the points you need to stay at BWV... compared to someone who bought more points somewhere else.

In fact, if you could actually get the room you want at 7 months (which generally you can't.. but if you could).. then it would be most economical to buy GFV points and use them at BWV -- That would be cheaper than buying BWV points. A point chart only tells you where it's cheap to stay, not where it's cheap to buy. Of course, because of unavailability at 7 months, if you want to stay in the cheaper place, you may need to buy there.

Check out the beach club interior renovation fund. $180k per villa on average. Absolutely ridiculous and proof we are all being taken for a rideThere’s no way on earth the Villa renovation cost $180k each. I’d have said more like $50k tops.

- Joined

- Nov 15, 2008

- Messages

- 48,183

Check out the beach club interior renovation fund. $180k per villa on average. Absolutely ridiculous and proof we are all being taken for a ride

Any funds in the capital improvement budget that do not get spend when the contracts end will be returned to owners,

Also, any money that is not spent each year goes into this fund.

Check out the beach club interior renovation fund. $180k per villa on average. Absolutely ridiculous and proof we are all being taken for a ride

That's not really accurate. It appears to be $38 million over the next 13 years for "interior refurbishment" over the next 13 years. Then they have a separate category for "common elements." It's not clear what aspects fall into which category. For example, BCV's share of Stormalong Bay refurb would fall under "common elements." But for the BCV lobby... hallways.... elevators... I'm not sure if those fall under interior refurb or common elements. (Is common elements = common within the BCV building, or common in regard to shared with BC/YC).

Further it's "replacement" cost, which isn't necessarily the same as renovation cost. Remember, they aren't collecting that replacement cost -- The capital reserve is much smaller. So that very well may be the cost of, "if a hurricane destroys the villas.. this would be the cost of replacing them."

There’s no way on earth the Villa renovation cost $180k each. I’d have said more like $50k tops.

Couple things.Check out the beach club interior renovation fund. $180k per villa on average. Absolutely ridiculous and proof we are all being taken for a ride

First it helps to adjust for the size of the room. A studio occupies 1 "bay" while a 1BR is roughly twice the size taking up 2 bays and 2BR three bays. Applying that logic to the room mix for BCV gives us 532 bays across all villa rooms. Dividing the $37.7 million by 532 bays = $70960 per bay. Or:

Studio Refurb = $70,960

One Bedroom = $141,920

Two Bedroom = $212,880

As for how the money is spent, that's a little vague. The useful life is always expressed in a range of years which cannot really be linked to a single refurb activity. DVC currently employs a cycle in which each room receives a soft refurb at 7 years and a hard refurb 7 years later. Because the budgeted refurb figure does not fluctuate in response to this schedule, I think it's reasonable to conclude that the estimated useful life encompasses at least 1 soft refurb AND 1 hard goods refurb. Frankly they aren't collecting monies at a rate fast enough to do more than that.

For 2023, DVC plans to collect $4.2 million for BCV capital improvements. Without adjusting for inflation, over a 14 year span they would collect $58.8 million. The reasonable assumption is that $37.7 million would cover the two room refurbs with the remainder going toward roof, exterior painting, parking lot and common area refurb (hallway, lobby, landscaping, pool, etc.)

Perhaps more succinctly, BCV is due for a full hard goods refurbishment within the next year or two. The fund is estimated to be $15.1 million at year end with another $4.2 set for collections in 2023. They don't HAVE $37.7 million to spend on a single room refurb project. If they completely drain the fund (unlikely) for a 2023 refurb, they could spend about half the amounts noted above per room.

Genie+

You can never spend enough

- Joined

- May 12, 2022

- Messages

- 6,183

We just stayed there for the first time and my husband really loved it! Even went as fas as saying it was his favorite after trying 7 other DVC resorts. I enjoyed it too but all park resorts are my favorite, lol. If we add another resort to our BW, will most likely be BLT or Poly (but Poly is dependent on what happens with the new build).BLT is really looking like a good buy right now, all around.

The Fab 5:

Mickey - GFV

Minnie - Poly

Donald - BLT

Daisy - BC

Pluto - BWV

The BLT was built on the cheap. Its plain ; small lobby and ridiculously small pool for the amount of rooms there. It reminds me of a hospital with a view. Thats probably why its so cheap .First of all, thank you for the post and data. 2 more line items for my 2023 budget are updated and are below estimated.

The dues ranking is all in all good to know, but a DVC member should also consider point chart for villa stays. While my BWV dues are in the top third, the points per night are almost the cheapest for standard villas. Hence, not accounting for buy-in costs (which were emotional high), my stays at BWV are significantly cheaper than other resorts with lower dues cost.

My BLT points continue to be the best bang for my buck, especially when factoring in my 2010 buy-in costs.

As always, YMMV.

They will 100% spend all the capital just before contract ends because they are going to resell the resort so will want it looking as new and clean as possible - gigantic con...Any funds in the capital improvement budget that do not get spend when the contracts end will be returned to owners,

Also, any money that is not spent each year goes into this fund.

- Joined

- Nov 15, 2008

- Messages

- 48,183

They will 100% spend all the capital just before contract ends because they are going to resell the resort so will want it looking as new and clean as possible - gigantic con...

They would not legally be able to do that and there is no evidence to suggest that they aren’t doing what they are supposed to do in terms of keeping the reserve fund at an appropriate level to support figure improvements that will be needed.

Take RIV. Roof repair/replace are estimated in today’s dollars for the 50 year contract are 4.9 million. It’s budget is based on a 20 to 40 year span.

If it only lasts the 20 years, the budget is to cover it needing ia full replacement a maximum of 2 1/2 times. And that $4.9 million also includes money for potential repairs along the way.

So the budget is allowing for less than $2 million for each replacement. Heck it just cost me almost $30k to do my roof 3 years ago and it’s no where near the size of RIV.

If the roof last longer, we will tsee that number adjusted so that by the time we het toward the end, that line item won’t be much at all.

In other words, if they replace the roof with 10 years left they can’t simply replace it 8 or 9 years later to spend down funds for a future project since they have told owners year after year that roofs should last at least 20 years, without refunding owners for the money due them for those 10 additional years when they won’t own the building any longer.

Last edited:

Any thoughts as to why the interest income on the reserve accounts is so small? For example, at BLT, they’re budgeted $18.5k of interest on $38.8M. That’s .04%. As interest rates rise, they should be putting a portion of the reserves into safe, secure interest-bearing accounts. Currently, rates are hovering in the high 2% range. This is poor fiduciary management.

- Joined

- Nov 15, 2008

- Messages

- 48,183

Any thoughts as to why the interest income on the reserve accounts is so small? For example, at BLT, they’re budgeted $18.5k of interest on $38.8M. That’s .04%. As interest rates rise, they should be putting a portion of the reserves into safe, secure interest-bearing accounts. Currently, rates are hovering in the high 2% range. This is poor fiduciary management.

Remember this is an estimate and actual figure will be reflected next year and credited applied.

So, I think what you are seeing in interest could be from this past year of what was actually earned. Not 100% positive though.

Last edited:

Nabas

DIS Veteran

- Joined

- May 5, 2013

- Messages

- 3,326

As I recall, many of the original fixtures (e.g. cabinet handles) at BLT had to be replaced within the first couple of years because they were breaking.The BLT was built on the cheap. Its plain ; small lobby and ridiculously small pool for the amount of rooms there. It reminds me of a hospital with a view. Thats probably why its so cheap .

Anyone else remember this?

Liquidice

DIS Veteran

- Joined

- Mar 10, 2019

- Messages

- 1,862

Comparison of the revenue and costs for BCV from last year to this year. I wonder why Housekeeping costs went up by 11.2%? Utilities also went up a lot. I know inflation is high, but certain things about the increases seem off.

There was a negligible change in funds for capital improvements and taxes were exactly the same so the bulk of the cost increase is coming from increased costs.

-

Our Go-To Disney Snacks & Meals: Magic Kingdom

-

Zeus Was the Star of 'Disney Hercules' and My Stateroom on the Disney Destiny

-

Race Weekend Discount + New Menu Items in Disney Springs

-

New Valentines Merch Spotted at Walt Disney World

-

Why Maharajah Jungle Trek Is One of Disney's Animal Kingdom's Best Experiences

-

TIME Honors Disney as One of America's Most Iconic Companies

-

Make Your Child's Disney Character Meeting More Memorable

New Threads

- Replies

- 0

- Views

- 104

- Replies

- 0

- Views

- 121

- Replies

- 2

- Views

- 170

- Replies

- 1

- Views

- 169

New Posts

- Replies

- 77

- Views

- 9K

- Replies

- 73

- Views

- 4K

- Replies

- 6

- Views

- 690

- Replies

- 6K

- Views

- 709K

- Replies

- 20K

- Views

- 1M

- Replies

- 20K

- Views

- 892K