CastAStone

Business nerd. Good at math. Bad at spelling.

- Joined

- Jun 25, 2019

- Messages

- 5,989

No doubt. And if you want to stay at the Grand Floridian or Beach Club or BLT, you should buy those, and if you never want to be stuck at Saratoga springs, then you shouldn’t buy that. And if it’s more important to you to own DVC then to analyze every penny, that’s fine!I have been a DVC member for 20 years and these comparisons are silly as these scenarios never happen. I have never seen someone prove that they avoided buying something (car, timeshare, boat, vacation, starbucks coffee) and then invest that money for a long term 6% growth. Sure there are one off stories, but not a conscious decision to avoid buying something and then invest in the stock market as a way to offset that expense.

Truth is - if you liek DVC and have the cash to buy it without financing, then go for it. Try to avoid financing. If you buy SSR or Poly or BLT, then they all are good.

That are many wildcards in timeshares, such as at one point OKW had way lower dues than AKV and now that spread has been closed. Disney does manipulate the system, but I am not sure it is on purpose to devalue something.

Buy where you love and try to get a good deal. There will always be someone that will claim to buy a resort cheaper than you or got a better deal. As long as you buy a good deal resale, you will be better than direct from Disney in terms of saving money.

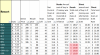

But when the question is specifically about sleep around points, and even more specifically discussing the value of 2066 expiration versus 2054, I don’t know how else to think about this than by trying to figure out how much to discount those 12 years.