An Epcot entrance DVC is interesting. The theming would be important to decide DVC add-on for us.

Please feel welcome to counter against the following reasoning  —— I’d appreciate any thoughts

—— I’d appreciate any thoughts

One of the positives of owning BW/BC with their 2042 expirations is the time value of money calculations.

You’re only prepaying less than 20 years into the future.

Comparison of buying 150 pts 2042 resort for $170pp vs 2064 for $150pp:

150pts resale $150 of 2064 resort = $22,500

If you were to invest that say for retirement, it’d be near a whopping $175k in 42 years at 5% interest:

Divide that 42 years left and on average it’s costing $4k a year over its entire life.

View attachment 766432

150pts resale $170 of 2042 resort = $25,500

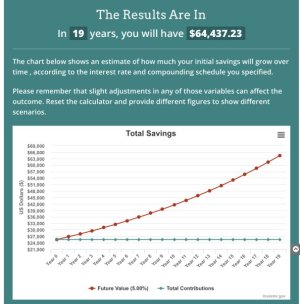

If you were to invest that say for retirement, it’d be near a whopping $65k in 19 years at 5% interest:

Divide that 19 years left and on average it’s costing less than $3.5k a year over its entire life.

View attachment 766433

Absolutely this isn’t the whole math story. It is a different way to look at it though.

We just bought in direct for less than our BWV resale per point. I still don’t feel like we overpaid for our smaller BW since the shorter contract suits us well. There’s no ‘perfect’ way to buy DVC, much depends on individual goals. The balance of EP area resort where the point chart we can stretch # of nights with a low dues MK resort that grants blue card works ok for us.

—— I’d appreciate any thoughts

—— I’d appreciate any thoughts