Takeitforgranite

Mouseketeer

- Joined

- Jul 7, 2025

- Messages

- 100

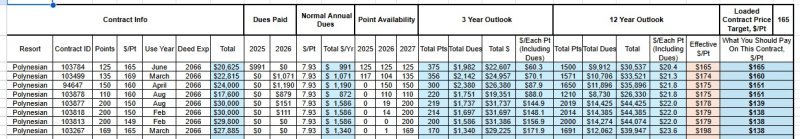

I’m in the market for a resale, and I built a spreadsheet to help try to capture the total value of a resale, especially when comparing loaded contracts and stripped. What I did was calculate the 3 year total cost per point (2025-2027) and the 12 year total cost per point. I am including dues, since that is large variable at closing. So far, I have only looked at Poly contracts.

If anyone is doing a different calculation, I would like to hear your thoughts. I was mainly just trying to prioritize ranking them against each other, and this is the best way I came up with. UY can make it a little tricky, especially when comparing FEB and DEC UY contracts, for example.

I would be happy to share my file if anyone wants it.

- I chose 3 year to look at the short term value of available points because of the wide range of available points and dues required at closing.

- I chose to also look at 12 year because that is what I calculated to be the break even point, when compared to renting privately. I also wanted to see whether or not loaded vs stripped really mattered long-term.

If anyone is doing a different calculation, I would like to hear your thoughts. I was mainly just trying to prioritize ranking them against each other, and this is the best way I came up with. UY can make it a little tricky, especially when comparing FEB and DEC UY contracts, for example.

I would be happy to share my file if anyone wants it.