Southernmiss

I am hazed everyday

- Joined

- Aug 27, 2011

- Messages

- 8,055

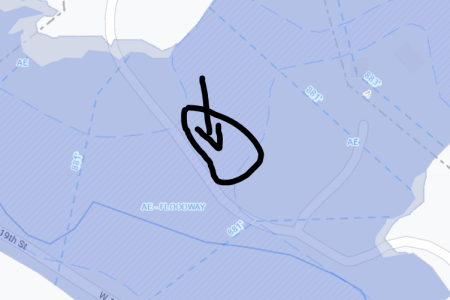

The closest body of water to us is a river 5 miles away. But we have wetlands behind us that are bone dry when there's no rain.

In 2016, we had 12 inches of rain overnight in 3 hours there was over 5 feet of water in the wetlands that came within inches of breaching our porch which sits 3 feet off the ground as our yard slopes. Our city had not maintained ditches near us and they filled too quickly in that event.

We took flood insurance out, even though it's not required and we are not in a designated flood plain.

I talked to the engineer last week who mapped out our neighborhood when it was platted 24 years ago. He was just as shocked by that rain event and what it did to the area as anyone. His own business got water in it with that event.

No matter how much planning is done by the experts and homeowners, stuff still happens.

In 2016, we had 12 inches of rain overnight in 3 hours there was over 5 feet of water in the wetlands that came within inches of breaching our porch which sits 3 feet off the ground as our yard slopes. Our city had not maintained ditches near us and they filled too quickly in that event.

We took flood insurance out, even though it's not required and we are not in a designated flood plain.

I talked to the engineer last week who mapped out our neighborhood when it was platted 24 years ago. He was just as shocked by that rain event and what it did to the area as anyone. His own business got water in it with that event.

No matter how much planning is done by the experts and homeowners, stuff still happens.