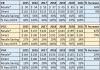

Quick analysis

I’m not touching on Dues here, that’s one for another day

Overall – big jump in Resale PPP in 2018, I haven’t worked out what that is yet?

AKV – Resale values have out-run the increase in direct, is a drop due? AKV and SSR by far biggest contract volumes and prices influenced by what is going to get through ROFR. Contracts were going through at $90-$99 last year but ROFR seems to have started again now.

AUL – Honestly, why not just go around offering $70 a point, never been ROFR’d.

BCV – Low level taken in last 2 years has helped bring resale PPP down a bit. Direct price is pretty much non-sensical.

BLT – Solid increases in resale and direct, ROFR has recently been painful, pushing average price up.

BRV – Is now $34 PPP cheaper direct than CCV, that value will surely keep growing.

BWV – More heavily ROFR’d than BCV, pushing it’s price up.

CCV – Small data samples – direct cost is going up so will eventually be followed by resale once contracts get taken by

DVC.

HHI – Direct and resale tracking each other well – those taken by ROFR appears to have slowed

OKW – high ROFR rate – it’s the old ROFR a 2042 contract and make it a 2057 contract trick

OKW-E – Resale at $110 and Direct at $165 – if it’s a 50pt contract at $130, you’re getting into the realms of buying direct if you can get the current UY points added as well

PVB – Lack of ROFR keeping prices low, one to watch – could see a big resale price increase if DVC start buying back a lot.

SSR – Similar to OKW-E, low point contracts may be not far off a direct price. Very high ROFR rates keeping prices fairly high.

VB – Resale increasing but Direct prices going nowhere

VGC – I mean 87% increase, Holy Cow!!!! If you got a $140 contract in 2017 you are laughing now. Resale saving is low but contract volumes are low and in high demand.

VGF – Disney is pushing direct price up and up, this is my No.1 resort tip for future growth of a resale contract. Only time will tell, don’t burn your money on my recommendation!