Ruttangel

BCV AKV BWV VGF DVC Owner

- Joined

- Jun 21, 2013

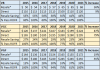

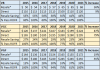

I've shown below some of my workings based on average PPP from @pangyal @ScubaCat ROFR thread and I didn't want to clutter that up.

I'll put my analysis up next but would be interested in anyone's views.

*the resale figure is average price from ROFR thread

I'll put my analysis up next but would be interested in anyone's views.

*the resale figure is average price from ROFR thread