This got me looking and thinking.

A few articles around the Interwebz suggests that the breakage on gift cards (the amount never redeemed) is in the neighborhood of 10%, maybe a little less. (See here for

one example). Some fraction of breakage is paid to the retailer for selling the card on behalf of the issuer (in this case, Disney). That rate has to be high enough to at least cover the swipe fees the retailer pays to process the sale of the gift card, but it is not so high that the issuer receives none of the breakage.

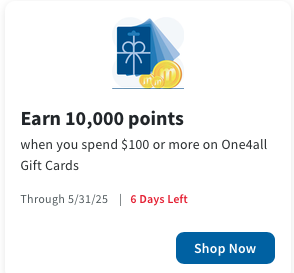

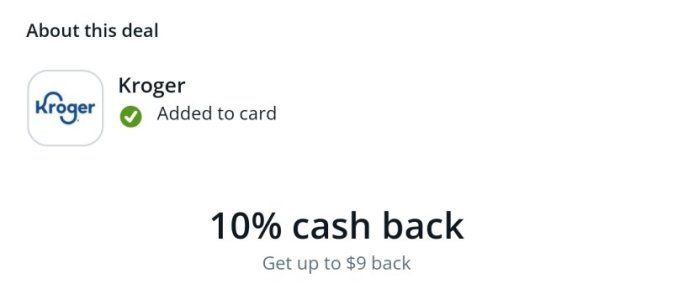

The gap between the swipe fees (2-3%) and the retailer incentive (5%-10%??? more ????) is how much room the retailer has to discount before the product becomes a loss leader.

My guess (and this is just a guess) is that the fee to the retailer is on the lower end of that 5-10% range, which makes sense. Gift cards are a low-cost product. They don't take up much room, and they are serviced by the issuer. But that also means that if a retailer is discounting by more than about 5%, those gift cards are a loss leader. Costco is not really in that business, because their per-item margins already tend to be tighter than those of their competitors. (they are capped at 14% for branded items; 15% for Kirkland/in-house).

So there just isn't that much room on Costco's business model for a loss leader---and that's the role gift cards discounted at 10% probably serve. But it all comes down to what a $100 gift card "costs" Costco to buy. If it is anything more than $90, then they aren't going to discount it to $90 very often.