You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Mortgage rates hit 20 year high......7%

- Thread starter tvguy

- Start date

Starport Seven-Five

DIS Veteran

- Joined

- Aug 16, 2019

- Messages

- 2,122

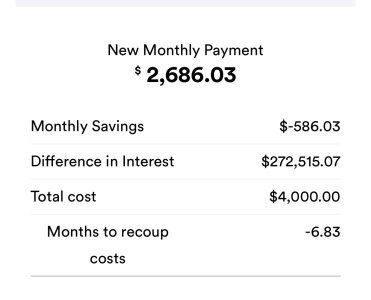

I don't know how but we timed a refi at the literal bottom of the market (2.5% on a 30 year). It's wild to see how different our mortgage payment would be with today's rates.

we bought in '91 and were in the double digits. a few years later we were thrilled to be able to re-fi for a few percentage points lower AND we had enough equity value to drop PMI-it made a huge impact on our budget.

808blessing

DIS Veteran

- Joined

- Dec 5, 2020

- Messages

- 1,171

we started at 4.8 refi to 3.8 and moved to a 15 year at 2.6 within a few years. I guess we won't buy a second home!

Last edited:

pigletto

DIS Legend

- Joined

- Oct 27, 2007

- Messages

- 14,405

How hard is it for Americans to refinance? Do most people do it several times over the course of the loan?

In Canada we have many different loan products but one of the most popular is the 5 year fixed. So you pay the same rate for 5 years ( generally amortized over 25 years ) and renegotiate at the end of every term. For example I bought in at 3.5% but it’s looking like it will be around 7% at renewal.

Where this will get really interesting ( and scary ) in Canada is all the people who bought during the pandemic frenzy of historically low rates and historically high prices. Those homes won’t be affordable at higher interest rates and I think a lot of people rushed into buying more than they could carry.

I know on the personal finance board I follow I’m already seeing people who are struggling because their variable rates are now too high. Fixed will take some more time to play out.

In Canada we have many different loan products but one of the most popular is the 5 year fixed. So you pay the same rate for 5 years ( generally amortized over 25 years ) and renegotiate at the end of every term. For example I bought in at 3.5% but it’s looking like it will be around 7% at renewal.

Where this will get really interesting ( and scary ) in Canada is all the people who bought during the pandemic frenzy of historically low rates and historically high prices. Those homes won’t be affordable at higher interest rates and I think a lot of people rushed into buying more than they could carry.

I know on the personal finance board I follow I’m already seeing people who are struggling because their variable rates are now too high. Fixed will take some more time to play out.

Starport Seven-Five

DIS Veteran

- Joined

- Aug 16, 2019

- Messages

- 2,122

Similar to getting the original mortgage. There are companies that specialize in it and walk the homeowner through it though.How hard is it for Americans to refinance? Do most people do it several times over the course of the loan?

As you probably know, the majority of loans in the US are 30 year fixed rate so we don’t have to refinance often. We just take advantage of lower rates when the market changes.

808blessing

DIS Veteran

- Joined

- Dec 5, 2020

- Messages

- 1,171

This is when we refi to save 2.2% on a 400,000 purchase -moved from30 to a 15 year. It was very easy. Just online docs. I also like to pay off additional payments instead of throwing into savings account bc I am saving 2.6%. Although I suppose if I had a higher 4% interest rate, I'd be "saving" more paying it off, but not.How hard is it for Americans to refinance? Do most people do it several times over the course of the loan?

********

Attachments

tvguy

Question anything the facts don't support.

- Joined

- Dec 15, 2003

- Messages

- 48,689

Well, technically a refinance is a new loan, and the old loan is paid off. It's easy to refinance*. I had 3 mortgages on my house, the original, and two refis. A 30 year fixed, a 30 year fixed, and a 15 year fixed. Even though the payments dropped with each refi, I kept paying the same dollar amount as with the first loan, with the extra money going to principle so we could pay off the mortgage early. So we bought our house in 1983 and it was paid off 17 years later in 2000. The last mortgage we had was the 15 year fixed at 6.25%, and we had it longer than the other two loans, 9 years.How hard is it for Americans to refinance? Do most people do it several times over the course of the loan?

In Canada we have many different loan products but one of the most popular is the 5 year fixed. So you pay the same rate for 5 years ( generally amortized over 25 years ) and renegotiate at the end of every term. For example I bought in at 3.5% but it’s looking like it will be around 7% at renewal.

Where this will get really interesting ( and scary ) in Canada is all the people who bought during the pandemic frenzy of historically low rates and historically high prices. Those homes won’t be affordable at higher interest rates and I think a lot of people rushed into buying more than they could carry.

I know on the personal finance board I follow I’m already seeing people who are struggling because their variable rates are now too high. Fixed will take some more time to play out.

My son and DIL bought a house in 2017 and refinanced in 2019 to a lower rate. They moved to another city and sold the house last year. My daughter bought a house in 2019 with a 4% mortgage and refinanced in 2021 at 2.3%. So refinances are common.

*Only issue refinancing I had was with the first refinance. It was with the same bank as the first mortgage, but the loan officer insisted we HAD to have put more than 5% down as the down payment. "We don't write mortgages with only 5% down" is what he said. This was in 1987 and the original loan documents were store in some secure location off site, and not accessible via computer. It took a couple of days to retrieve those documents and the loan officer was honestly shocked when he saw we only put 5% down. It was a special first time buyers program he had not heard of. And that program was dropped because a lot of borrowers defaulted, the 5% down wasn't enough to cover the banks foreclosure costs, and they almost went belly up. The finally were bought up by another bank. Waiting for those documents did delay the refinance by a couple of days.

I know it all works out in the wash, high interest means lower home values, and vice versa. Personally, I would rather high home values and low interest rates because the bank deserves nothing.

unless you live in one of the places where the higher values mean higher property taxes. when i read what some people pay for just their property taxes it exceeds any p/i payment i ever made on any home i've ever owned (and those obligations don't generally decrease over time so it's for the life of the home ownership).

lsutigers03

DIS Veteran

- Joined

- Aug 14, 2019

- Messages

- 1,126

I locked in 2.625% on a 30 year last September. I might never move out of my house.

That’s a very good point, but having a high value has benefits also- home equity to tap into in ann emergency. It’s why I think a lot of newly retire people are going to be in a world of hurt this winter. High rates, high inflation, 401k losses, high heating costs, and less ability to reverse mortgage or HELOC (terrible ideas but good in an emergency) due to house prices crashing.unless you live in one of the places where the higher values mean higher property taxes. when i read what some people pay for just their property taxes it exceeds any p/i payment i ever made on any home i've ever owned (and those obligations don't generally decrease over time so it's for the life of the home ownership).

That’s a very good point, but having a high value has benefits also- home equity to tap into in ann emergency. It’s why I think a lot of newly retire people are going to be in a world of hurt this winter. High rates, high inflation, 401k losses, high heating costs, and less ability to reverse mortgage or HELOC (terrible ideas but good in an emergency) due to house prices crashing.

i think it depends on how long ago those retirees bought. if during the last few crazed years or during the '00s boom then their home could have dropped to have little or no equity but if they bought during a stable market (not even nesc. a 'buyers') and have had it for a decade or so then the equity over what they paid/owe should still be somewhat decent b/c housing prices have come nowhere near to the losses we saw post '06 (my former home sold in '06 and just this year is valued at the '06 selling price, my current home was purchased in '07 and despite prices dropping steadily in our area we could still make almost a 100% profit on it selling today).

that said-i am not a fan of viewing home equity as an emergency fund unless it is the most DIRE of emergencies.

Last edited:

Jwaire

DIS Veteran

- Joined

- Sep 17, 2020

- Messages

- 1,285

How hard is it for Americans to refinance? Do most people do it several times over the course of the loan?

Not hard enough. In fact, I think it's way too easy and has almost become a predatory practice by some banks and mortgage brokers. Good friends of mine have refinanced their home TWICE in 5 years and are currently about to list their home.

Fees, closing costs, upon fees and closing costs to save 1-2% of interest you'll never pay because you "upgrade" to a new home every 5 or 7 years.

If it's your forever home or you plan to stay in it for awhile, it's one thing but a lot of people don't understand what they're even doing. They're just trying to lower their monthly payment by restarting the mortgage.

Last edited:

tvguy

Question anything the facts don't support.

- Joined

- Dec 15, 2003

- Messages

- 48,689

Just depends. Being cheap and having a good financial advisor is serving me well. Retired in July 2021, living off savings. When Social Security kicks in in 14 months at my full retirement age, those checks will be more than i was bringing home working. On Medicare now, that cut my health insurance costs by $400 a month, and my out of pocket from $5,000 a year to $233.That’s a very good point, but having a high value has benefits also- home equity to tap into in ann emergency. It’s why I think a lot of newly retire people are going to be in a world of hurt this winter. High rates, high inflation, 401k losses, high heating costs, and less ability to reverse mortgage or HELOC (terrible ideas but good in an emergency) due to house prices crashing.

The majority of my investments have guaranteed values and guaranteed annual income, the actual cash value only comes into play if I cash them in instead of taking distributions. House has lost about $100,000 in value but is still worth 5 times what I paid for it in 1983.

Only concern is health.

RamblingMad

I'm an 80s kid too.

- Joined

- Mar 29, 2019

- Messages

- 8,005

I'm never going to have to refinance ever again. Mortgage lenders are going to feel a lot of pain.

Last edited:

I'm never going to have to refinance every again. Mortgage lenders are going to feel a lot of pain.

us too but i suspect if the trends continue upward people will adjust just as they did back in the day when we were paying double digit mortgage interest rates. if you want a house and 'the norm' ends up being in the higher digits then that's what you deal with. if you look at the past 50 years in the u.s. it's only been since 2008 that rates have been steadily below 6%-14 years out of 50 which is a fairly small amount of time but i guess if that's all anyone has been 'aware of' (as in an adult looking at housing prices and considering/weighing the impact of rates) then it would be shocking.

I just checked, my monthly property tax is about $100 more than my mortgage payment (I have them bundled).unless you live in one of the places where the higher values mean higher property taxes. when i read what some people pay for just their property taxes it exceeds any p/i payment i ever made on any home i've ever owned (and those obligations don't generally decrease over time so it's for the life of the home ownership).

tvguy

Question anything the facts don't support.

- Joined

- Dec 15, 2003

- Messages

- 48,689

Ouch. My property taxes in 2022 are $2,527 a year. County can't raise them more than 2% a year in California due to Prop 13 passed in 1978.I just checked, my monthly property tax is about $100 more than my mortgage payment (I have them bundled).

Paid $101,000 for the house in 1983 and my payment was $1,100 a month. Property taxes then were $1,100 a year.

2022 appraised value is $217,000, market value is $458,000 to $536,000 depending on which website you look at.

That’s a great deal. It must be rough to balance a municipal budget on that though, unless it’s a very small town.Ouch. My property taxes in 2022 are $2,527 a year. County can't raise them more than 2% a year in California due to Prop 13 passed in 1978.

Paid $101,000 for the house in 1983 and my payment was $1,100 a month. Property taxes then were $1,100 a year.

2022 appraised value is $217,000, market value is $458,000 to $536,000 depending on which website you look at.

-

Disneyland's 70th Gets a Colorful Stoney Clover Lane Drop

-

Are Disney's New Women's History Month Photo Ops Lacking?

-

The Magic Kingdom's PeopleMover is Always a Good Idea

-

Disney Took the Spa Out of 'Resort & Spa' and Never Put It Back

-

Photo Tour - Club Level Rooms and Lounge at Disney's Boardwalk

-

New Winnie the Pooh Exclusive Disney x Loungefly Set!

-

Disney's 2026 Movie Slate Brings NEW Star Wars, Pixar & More

New Threads

- Replies

- 1

- Views

- 196

- Replies

- 0

- Views

- 122

- Replies

- 0

- Views

- 855

Disney Vacation Planning. Free. Done for You.

Our Authorized Disney Vacation Planners are here to provide personalized, expert advice, answer every question, and uncover the best discounts.

Let Dreams Unlimited Travel take care of all the details, so you can sit back, relax, and enjoy a stress-free vacation.

Start Your Disney Vacation

New Posts

- Replies

- 8K

- Views

- 980K

- Replies

- 390

- Views

- 92K

- Replies

- 74

- Views

- 17K

- Replies

- 3K

- Views

- 641K

- Replies

- 16

- Views

- 2K

- Replies

- 33K

- Views

- 2M

- Replies

- 41K

- Views

- 5M