Mackenzie Click-Mickelson

Chugging along the path of life

- Joined

- Oct 23, 2015

- Messages

- 31,153

Our governor just veteod a flat tax (although it could get over-ridden).I agree with your first two points but not the last. I do believe that in recent history we did have a commander and chief who wanted more peace.

As far as a flat tax goes, why wouldn't all income including interest and dividend income be included in the flat rate? Isn't that point of a flat tax, to make all income taxable at the same rate effectively simplifying the whole process? Remember the idea of being able to file your tax return on a postcard? Eliminating the need for all those schedules? I think it would be great if our government would adopt this plan but I'm sure it will never happen because the upper class would have to pay too much.

Estimates that 38% of the tax relief would go to the top 2% of earners.

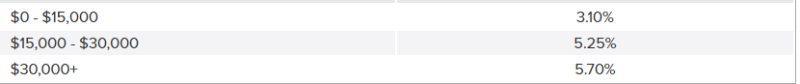

Presently our tax rate in our state is just 3 levels

The flat tax proposed was 5.15% (which was the percentage agreed upon in the final bill but the original amount was slightly higher before in earlier talks) with the following income: "$6,150 for an individual or $12,300 for a married couple."

Estimated "savings" more than $250 per month in savings to those who earn more than $250,000 per year. Individuals who earn between $25,000 and $75,000 would get receive $5 to $8 per month in tax relief.

This is why flat tax continues to be unpopular.