Insurance is so confusing to me. I plan to ask a few different questions here and welcome any help or suggestions!

First question is...

I have a term life insurance policy on my stepfather with AARP NY Life.

I'm paying $40 per month for $15K life insurance and $50K AD&D. Policy began 2013 and is good until he's 80 years old. I don't expect that he will make it past 80 years old.

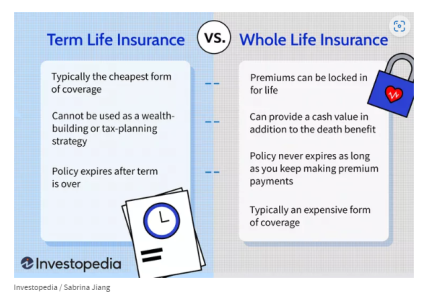

I keep getting solicitations to switch to "permanent life insurance." Not a good idea right? (The rates always seem quite high so I've just stuck with what I have already.)

Also is the price ($40) for the coverage listed above a good price?

I think I can increase this policy to $150K. I wonder if I should do that...

Finally - this is tax free money, right? Or should I scrap this policy and start putting $40 in Roth IRA instead? Thing is he's 63 and my attempt at reaching $15K in an IRA might outlive him so maybe I just keep going with the insurance?

Thanks for your help!

First question is...

I have a term life insurance policy on my stepfather with AARP NY Life.

I'm paying $40 per month for $15K life insurance and $50K AD&D. Policy began 2013 and is good until he's 80 years old. I don't expect that he will make it past 80 years old.

I keep getting solicitations to switch to "permanent life insurance." Not a good idea right? (The rates always seem quite high so I've just stuck with what I have already.)

Also is the price ($40) for the coverage listed above a good price?

I think I can increase this policy to $150K. I wonder if I should do that...

Finally - this is tax free money, right? Or should I scrap this policy and start putting $40 in Roth IRA instead? Thing is he's 63 and my attempt at reaching $15K in an IRA might outlive him so maybe I just keep going with the insurance?

Thanks for your help!

and this policy

and this policy