Chase now has pop up jail with unspecific eligibility requirements per DOC.

https://www.doctorofcredit.com/chas...-eligibility-determination-chase-pop-up-jail/

Thanks, that’s exactly what is happening to me.

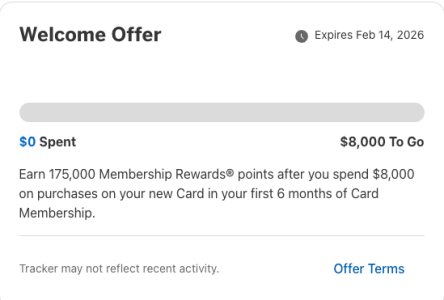

Will need to sit down and figure out what our next SUB is (property tax time). I’m finishing up an Amex Green (I was able to get the SUB offer even though I had a 3 yr old Plat, then canceled my Plat after no retention offers. Which is funny because I get a retention offer a few years ago when I was planning to keep it anyway. This year I did plan to cancel w/o a retention offer as I found it tougher to justify the AF, but didn’t get one despite legit and specific discussion with reps a few times.)

We’ve (me) actually slowed our SUBs a bit, but boy I could use some URs (we’ve each got 2 Inks, I have CSP, DH now with 2 Freedoms after PCing his CSP).