SouthFayetteFan

Saving Money on Disney Vacations since 2006

- Joined

- Sep 6, 2014

- Messages

- 13,150

PDF of report:

https://thewaltdisneycompany.com/app/uploads/2021/02/q1-fy21-earnings.pdf

Diluted earnings per share down 98% vs. prior year quarter. Wow! $113MM paid in severance in this quarter alone.

Most of this is just my armchair banker analysis.

Domestic Parks saw a revenue decrease of $3.5 billion (70%).

- Last year they did $4.9 billion in revenue with $3.4 billion in expenses, netting $1.5 billion in income

- This year is $1.5 billion in revenue, they were able to cut expenses to $2.3 billion, and showed a $798 million loss.

I wonder what portion of those expenses are fixed costs at DL and what the P&L for WDW alone looks like right now.

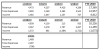

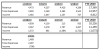

Here is a quick analysis I did on domestic parks dating back for many quarters:

Q1 of Fiscal'21 shows improved revenue vs. Q4 LY. Of course Q3 had the parks closed the entire quarter.

Interesting takeaway, Disney incurred $1.8 billion in expenses in this division during a quarter where the domestic parks were closed entirely. That starts to give us a sense of just how high the fixed expenses might be here, although nothing I'm presenting can be taken as accurate. I'm piecing together information from the 10k and 10Qs.

My best guess though is that WDW is now at least generating a breakeven against their portion of the fixed costs... heck, it might even be generating a profit at this point... It's hard to say how much of that $798MM loss is tied to DLR and its dead weight.

A question on the call was asked about capacity:

- She even said "you're only at 35% capacity a few days a year."

- Chapek's answer: "We are currently operating at 35% of that full capacity."

That sort of did clarify though that some busier days right now might feel pretty normal to Pre-COVID. 35% is a fairly significant number! Also mentioned, there was no capacity increase since November. Seems to indicate to me that MANY days are operating well below the capacity right now.

BlogMickey article regarding the above tweet:

https://blogmickey.com/2021/02/disn...-park-mask-mandate-social-distancing-in-2022/

https://thewaltdisneycompany.com/app/uploads/2021/02/q1-fy21-earnings.pdf

Diluted earnings per share down 98% vs. prior year quarter. Wow! $113MM paid in severance in this quarter alone.

Most of this is just my armchair banker analysis.

Domestic Parks saw a revenue decrease of $3.5 billion (70%).

- Last year they did $4.9 billion in revenue with $3.4 billion in expenses, netting $1.5 billion in income

- This year is $1.5 billion in revenue, they were able to cut expenses to $2.3 billion, and showed a $798 million loss.

I wonder what portion of those expenses are fixed costs at DL and what the P&L for WDW alone looks like right now.

Here is a quick analysis I did on domestic parks dating back for many quarters:

Q1 of Fiscal'21 shows improved revenue vs. Q4 LY. Of course Q3 had the parks closed the entire quarter.

Interesting takeaway, Disney incurred $1.8 billion in expenses in this division during a quarter where the domestic parks were closed entirely. That starts to give us a sense of just how high the fixed expenses might be here, although nothing I'm presenting can be taken as accurate. I'm piecing together information from the 10k and 10Qs.

My best guess though is that WDW is now at least generating a breakeven against their portion of the fixed costs... heck, it might even be generating a profit at this point... It's hard to say how much of that $798MM loss is tied to DLR and its dead weight.

A question on the call was asked about capacity:

- She even said "you're only at 35% capacity a few days a year."

- Chapek's answer: "We are currently operating at 35% of that full capacity."

That sort of did clarify though that some busier days right now might feel pretty normal to Pre-COVID. 35% is a fairly significant number! Also mentioned, there was no capacity increase since November. Seems to indicate to me that MANY days are operating well below the capacity right now.

BlogMickey article regarding the above tweet:

https://blogmickey.com/2021/02/disn...-park-mask-mandate-social-distancing-in-2022/

Your approved.....

Your approved.....