I’m with you

@DanCali and agree with you that subsidized contracts are worth well more than where they currently trade in the market and well north of $30/pt.

Another way to think about it is if you are going to own Aulani points in one form or another (subsidized or not) you are effectively earning (via savings) the subsidized amount each year you own the contract.

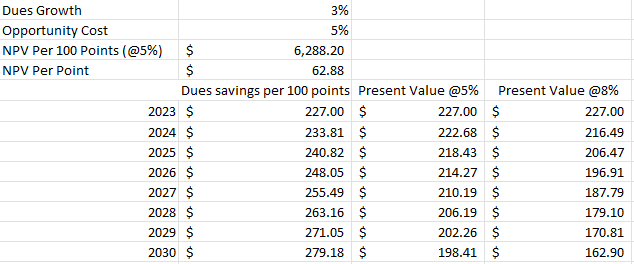

It’s a cash flow paying ~$2.27/year per point growing at ~3 to 6% a year for the next 39 years. You can discount that cash flow stream back to whatever discount rate you want. To @DanCali’s point, at a 5% discount rate it’s north of $60 present value assuming 3% dues inflation per year. At a 4% annual dues increase at the 5% discount rate the present value increases to north of $70.

At the current ~$30 premium for subsidized vs non-subsidized points it’s north of an 11% Internal Rate of Return assuming 4% annual increases. If you are going to own Aulani in some form, paying up for the subsidized contracts is a high IRR investment with minimal risk and extremely tax efficient. I say tax efficient because you’re not having to pay taxes on any of your savings like you would on a regular dividend paying cash flow and it’s after tax money you are saving.

Of course, that doesn’t mean every subsidized contract out there is a steal and people still need to shop around and wait for the right contract to become available.

As a side note I’m currently in contract to sell my last Aulani non-subsidized contract while also in contract to buy yet another subsidized one. The one I’m selling is stripped and the one I’m buying is 2x current use year points with the 2022 points having been banked. The market also gets the value of stripped vs fully loaded contracts wrong but that’s a post for another time.