With all due respect, I like to run my own numbers

When I do that, I believe the

subsidized (unstripped) contract should be in the $150-$160 range as a fair price, and that's probably even conservative. That may be an unconventional thought, but I'll justify that below with a very simple analysis, but it does require understanding net present value calculations. Take a look at tell me where I went wrong

There are many assumptions people can make about opportunity cost, treasury rates, whether people are overpaying or underpaying for the subsidy now, and whether that will reverse in the future. But you can ask a very simple question and make very simple assumptions.

Consider 100 points as an example...

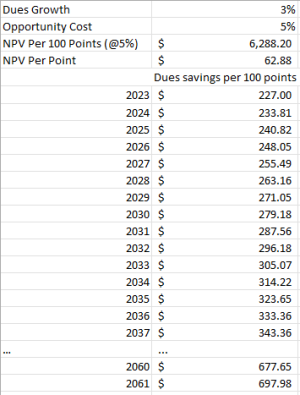

(i) The value of the dues savings for 100 points in 2023 is $227 - that's an uncontroversial starting point.

(ii) Assume dues grow at 3% per year which also means the dues savings grow by 3% per year (picked a low number, which biases the analysis I'm about to do against subsidized since the dues savings don't grow as fast)

(iii) Pick an opportunity cost - say 5% as you cite - and use that to discount all the future cash flows to get everything in present value terms

There are only 2 variables here - the percentage annual increase in dues (which is also the percentage increase in dues savings each year) and the opportunity cost, which you use to discount the dues savings cash flow stream from 2023 to 2061... So what is that stream of cash flows (dues savings till 2061) worth to you today in present value terms given your opportunity cost you picked?

That number will be (up to) the extra amount you should be willing to pay for the Aulani subsidized contract...

The answer to that with 3% dues savings increase and 5% opportunity cost is $6288 (that's the present value of cash flows starting at $227 in 2023, growing at 3% annually to $698 in 2061 and discounted at 5%). That means, that for 100 points, you should be willing to pay about $63/point more for the subsidized contract. Now if the subsidized contract is stripped vs the unsubsidized one, you can say you rent out those extra points from the unstripped contract for $10-$12/point (above annual dues, which you'd have to pay) so that brings does the premium for the subsidized contract from $63 to around $40-$45 per point, not far from where we are today. So, I agree with you on the loss of value from stripping, just not about the fair value of the subsidy itself. If anything, people are slightly underpaying for stripped subsidized contracts at $130.

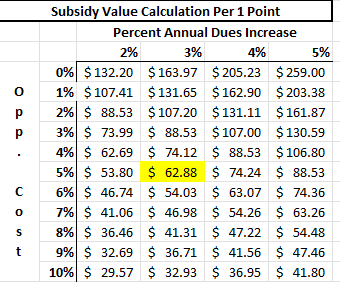

You can also do some sensitivity analysis around the 3% and 5% numbers. The more the dues increase, the greater present value of the subsidy. The greater the opportunity cost, the less the value of the subsidy (because the dues savings are worth less in present value terms). Here is what you get for various values. Note that with 5% dues increase (a number you mentioned in your most recent post) the subsidy value with 5% opportunity cost goes up from $62.88 to $88.53/point.

View attachment 786393

When I do that, I believe the subsidized (unstripped) contract should be in the $150-$160 range as a fair price, and that's probably even conservative. That may be an unconventional thought, but I'll justify that below with a very simple analysis, but it does require understanding net present value calculations. Take a look at tell me where I went wrong

When I do that, I believe the subsidized (unstripped) contract should be in the $150-$160 range as a fair price, and that's probably even conservative. That may be an unconventional thought, but I'll justify that below with a very simple analysis, but it does require understanding net present value calculations. Take a look at tell me where I went wrong