First thing you need to do before deciding on insurance is review the coverage you already have.

1) Check your credit card company. If you paid for the trip with that card you may have some sort of coverage.

2) Check you Health Insurance. Every group policy I have had included coverage overseas and Medical Evacuation because employees sometimes had to travel out of the country for work. And at one of the healthcare presentations the insurance rep was asked about that and said they provide the coverage for two reasons. First, they get few claims for out of the country coverage so it is low risk for them Second, not counting Medical Evacuation, healthcare costs are generally much lower outside the U.S. so they save money if a customer needs care outside the U.S.

3) I went on Medicare Part A and B this year, it does

NOT cover health care outside the U.S.

HOWEVER, in picking my private Part G coverage not only covers healthcare outside the U.S., it covers Medical Evacuation.

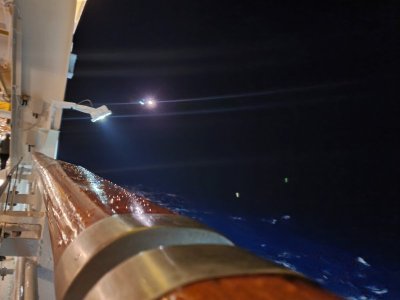

4) And if you are a U.S. Citizen on a cruise within reach of the U.S., say in the Caribbean, the U.S. Coast Guard most likely will be doing the evacuation. Check the Cruise Line Forum here and see how many medical evacuations people there have reported from the ships in the Caribbean or

Castaway Cay, and it almost always is the U.S. Coast Guard, and there is no charge for that to U.S. Citizens

So yes, you can buy comfort with

travel insurance, and it isn't going to hurt anything but your wallet to buy it, you may be paying for coverage you already have. So do your homework.

That is one of those thing that just comes out of nowhere and needs to be handled asap.

That is one of those thing that just comes out of nowhere and needs to be handled asap.