TipsyTraveler

DIS Veteran

- Joined

- Jan 9, 2014

- Messages

- 4,699

Nope. Prices are up 40% over what we paid just under two years ago.

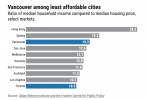

You are correct, I meant to say "cost of housing", not cost of living. For housing, Vancouver is third in two categories.What list are you looking at?

You are correct, I meant to say "cost of housing", not cost of living. For housing, Vancouver is third in two categories.

This survey compared housing unaffordability by examining median home prices and household incomes in key markets.

View attachment 664569

https://vancouversun.com/news/local-news/vancouver-third-least-affordable-city-demographia

And a recent survey by Capital on Tap found that Vancouver was also the third most expensive city to build a house:

https://www.bcbusiness.ca/Vancouver...e-city-in-the-world-to-build-a-house-in-great

View attachment 664572

Almost all loans that are written that include PMI have it written into the life of the loan. In order to not have PMI you have to refinance into a loan that doesn't include it. It's not a law change it's a policy change that the contracts no longer include an automatic mechanism to remove it when the LTV gets below 80%. How much extra money they make from people that forget about it or don't know that they shouldn't be paying for it, I'm sure it's a lot.When did this happen with not being able to remove the PMI? PMI, like GAP insurance, is supposed to protect the bank from losses with higher risk borrowers within a high liability space on 20% loan to value, there is no sound justification for in within that 20% space so it's exploitative and predatory to prevent people from dropping it. If the laws changed to prevent dropping it then it's also really unethical that this went through because dropping it means people need to pay closing costs to exit the system.. WTH?

That's not how our loan was written. Ours was maturation date or refinance not the life of the loan.Almost all loans that are written that include PMI have it written into the life of the loan. In order to not have PMI you have to refinance into a loan that doesn't include it. It's not a law change it's a policy change that the contracts no longer include an automatic mechanism to remove it when the LTV gets below 80%.

I went through our original paperwork and neither my husband nor I could find it but that was disclosed to us during closing and it could have been disclosed to us incorrectly; we had a conventional loan but honestly we could have just been told incorrectly it's just what we've thought since the original loan was taken out in 2014. We def. didn't have it where it was the life of the loan. We weren't considered high risk borrowers and our loan was not considered high risk but the PMI was assessed due to the low down payment percentage. Our down payment looking at it was just over 5%. At that time our neighborhood the developer and builders were perfectly fine with 5%-10% down payment and assumedly are still at least close to that.When did this happen with not being able to remove the PMI? PMI, like GAP insurance, is supposed to protect the bank from losses with higher risk borrowers within a high liability space on 20% loan to value, there is no sound justification for in within that 20% space so it's exploitative and predatory to prevent people from dropping it. If the laws changed to prevent dropping it then it's also really unethical that this went through because dropping it means people need to pay closing costs to exit the system.. WTH?

I actually mentioned that in my OP since we own outright too, but it would cost money (closing costs) so doing that would be ridiculous.Of course because I would also own a home that would sell for the same amount.

That's not true at all for some. We could and we're retired.If you are in a home for 20 or more years, no, you could not afford to buy your current home today.

wages have not kept pace with the cost of housing.

I went through our original paperwork and neither my husband nor I could find it but that was disclosed to us during closing and it could have been disclosed to us incorrectly; we had a conventional loan but honestly we could have just been told incorrectly it's just what we've thought since the original loan was taken out in 2014. We def. didn't have it where it was the life of the loan. We weren't considered high risk borrowers and our loan was not considered high risk but the PMI was assessed due to the low down payment percentage. Our down payment looking at it was just over 5%. At that time our neighborhood the developer and builders were perfectly fine with 5%-10% down payment and assumedly are still at least close to that.

However, we did notice that the interest rate I mentioned was incorrect. It looks like the 4.50% was the first interest rate when the new build was starting and we rate locked at 4.25% within 45 days of our closing date (2014) when the house was scheduled to be complete. When we refinanced the first time in 2017 we got a new rate of 4.125% so hardly much reduction (that part I remember correctly) but the remainder of the PMI was gone.

IDK when I originally made the comment it was just a thought to mention about looking at refinancing due to values of homes. Much in these housing stuff does depend on a person's particular loan admittedly. When the other poster refinanced to get 7% by paying 10K to get that it wasn't mentioned when that happened. My husband was just looking around and said from what he could find it hasn't been 7% until now (and ones are 5-6/7% at the moment) for about 20 years.

I am that poster.Interest rates are now up around 5%, so that might increase their payment if they refinance. They could be better off just doing what they’re doing.

We had actually lost value the first time we refinanced, so we had to cough up an additional $10K just to get to a 7% refi.

If you are in a home for 20 or more years, no, you could not afford to buy your current home today.

wages have not kept pace with the cost of housing.