I don't disagree at all. There is always value in owning over renting.My VGC purchase made a year ago I am at $16.04 per point. It's very rare to see someone renting VGC for the standard $20 per point, it typically is $24 all the way up to $35. As cash prices increase and dues increase rental rates will have to follow suit. Also there is value in owning vs renting.

My comment was based on having enough money to buy a contract at $257pp, then paying yearly fees while investing the rest at 6% vs using that same amount of money and renting points at $22 pp and investing the rest at 6%.

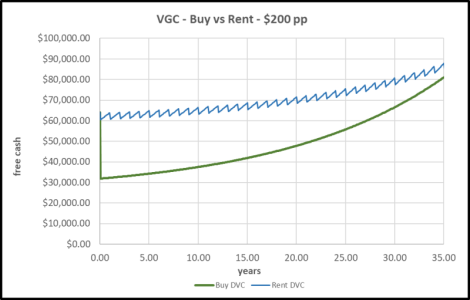

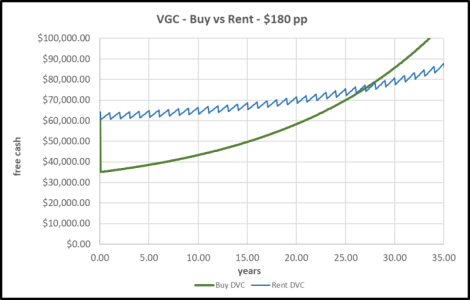

If you vacation every year until 2060, you are better off renting at VGC over buying if it is a purely financial decision. At $200 pp you basically break even. Lower than that ($180 pp), buying is the better option.

There are obviously lots of factors left out. Inflation, market change, % of fee increase vs rental price increase etc.

Attachments

Last edited: