nuhusky123

DIS Veteran

- Joined

- Oct 1, 2021

- Messages

- 1,007

If the price is in the $255 range ill be fascinated to see sales over next six months. I’d expect pathetic sales numbers but also open to dvc surprising meMy guide said the price will not be announced before sales start so offically, we won’t know until March 3rd.

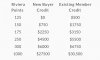

I did my number crunching using a few different situations since the max we will go is 125.

So, close to $200, will do anywhere 80 to 125. In the $220s, then it’s 50. At $255, in no rush.

Personally, I think we will be able to purchase what I want because it will be similar to RIV. I will be sad if it is not. At least we are only 10 days away!

sales In March which will likely all be from dvc members won’t reflect true interest in gfv. Not until the dvc buyers drop off and non members get a crack at this will we really know how successful gfv is going to be