RWeThereYetJJ

Earning My Ears

- Joined

- Mar 10, 2024

- Messages

- 35

Can someone help me understand how to read the Capital Reserve Analysis from the Annual Meeting Notice?

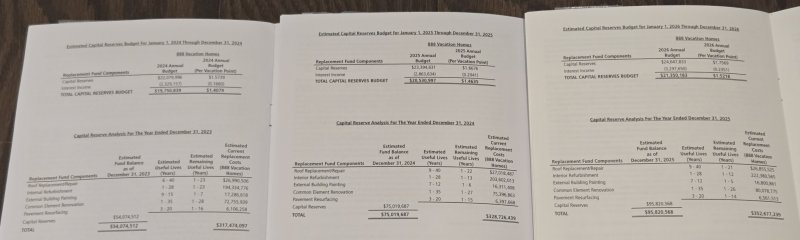

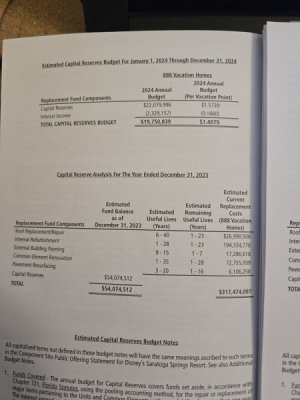

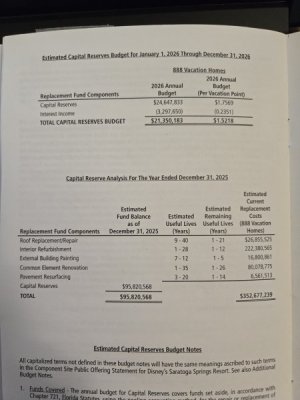

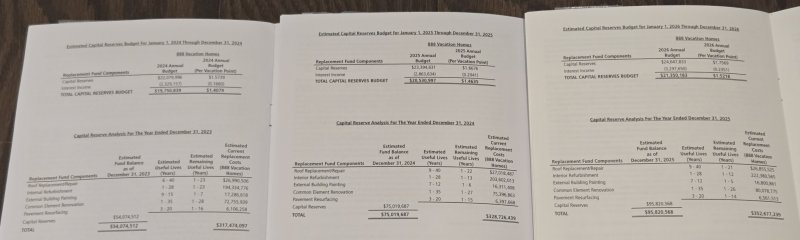

Below is a picture of the 2023, 2024, and 2025 Capital Reserve Analyses for SSR from the Annual Meeting Notices I received in the mail. The 2025 Estimated Funded Balance of $95.8m seems low to my uneducated eye at 27% of the $352.7m Current Replacement Costs (right side of picture) with a soft-goods refurb coming in the next year or two. The Estimated Remaining Useful Lives column appears to be counting down over time. Take the External Building Painting row as an example: It goes from 1-7 in 2023 to 1-6 in 2024 to 1-5 in 2025. How does that help determine the cash that should be on hand?

Below is a picture of the 2023, 2024, and 2025 Capital Reserve Analyses for SSR from the Annual Meeting Notices I received in the mail. The 2025 Estimated Funded Balance of $95.8m seems low to my uneducated eye at 27% of the $352.7m Current Replacement Costs (right side of picture) with a soft-goods refurb coming in the next year or two. The Estimated Remaining Useful Lives column appears to be counting down over time. Take the External Building Painting row as an example: It goes from 1-7 in 2023 to 1-6 in 2024 to 1-5 in 2025. How does that help determine the cash that should be on hand?