AstroBlasters

DIS Veteran

- Joined

- Oct 23, 2022

- Messages

- 9,152

I actually think the combos you mentioned as “the worst” are more optimized.I was surprised this got so many upvotes. Am I missing something or is this not just letting the calendar year difference confuse things?

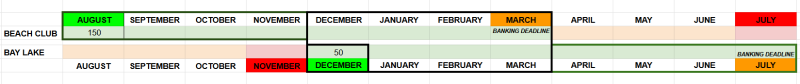

A Dec & a Feb UY have 10 months of overlap. The fact that it’s Dec’24 and Feb’25 that have that overlap doesn’t actually matter. It’s the same functional overlap as having an April & June or October & December UY.

Seems to me the worst combination would be something like March & September, April & October, or June & December…

As an example, if someone is a teacher who has summers and holidays off (and magically doesn’t need to work a 2nd job) then I could see them getting a DEC UY and June UY.

They can get enough points in each UY for a vacation and they won’t have to worry about being past a banking period if they need to cancel the trip.