DonkeyHoTay

I see stuff that isn’t there

- Joined

- Apr 29, 2024

- Messages

- 604

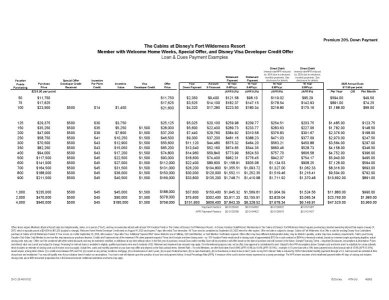

CFW = 166.66 per points with MB...Not bad

That is getting competitive... wonder if that will be enough to move real points there.

Not bad, until you consider the resale value of those contracts...

big mystery is with the Cabins and LSL.

I guess three reasons why people will buy small contracts at CFW:

- resale restrictions

- high dues

- room booking cost is low

Maybe small contracts help maintain resale price per point at CFW in the future, especially since fewer points can go a long way at that particular resort?

I still am having trouble getting my mind around nearly $12 MFs.

For sure, I would think twice about buying a lot of points at CFW. But at 150 points, the difference between avg. MFs at other resorts vs CFW is around $300 a year - not enough to break most banks.