Where is your evidence that they are mis-applying costs because the SEC would be very interested in it. Our old friend Chapek tried to pull that and it helped get him fired and you think it is still happening?

There's lots of ways to allocate costs. But just come along with me for a very simple exercise. The amount of original content on

Disney+ is very high relative to the Disney Channel, and also very expensive, including Star Wars series which I'm certain are not cheap. And what does each customer pay per month? Looks like it's about

$8/month in Disney+ revenue per subscriber (I only pay $2.99, because we keep getting offers to come back to Disney+ that are way below their list price).

On cable TV, ESPN alone is at least $10/month of the bill, and Disney gets the benefit of the bundle (you can't only subscribe to Disney on cable... the packages always include both Disney and ESPN).

~$20/month of your cable bill goes directly to Disney.

There is currently no real direct-to-consumer ESPN option (at least not until August 21st). And the ESPN+ subscriber numbers are wonky because of the number of customers bundling with Disney+. Basically, there's no ESPN DTC market today, or it's small potatoes if you want to count ESPN+, so we'll leave that out for now.

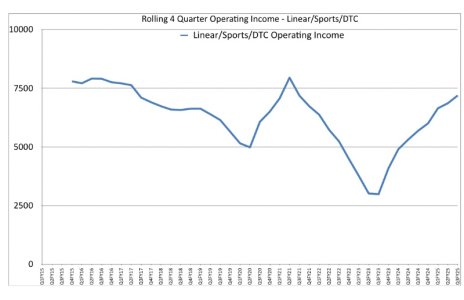

So for every Disney+ subscriber coming from the world of cable or satellite, Disney is down $12 in revenue. And their costs are higher on Disney+. Disney+

pays their linear TV side for their own content with transfer pricing, and they can effectively set whatever price they want. They choose a price that gives their Disney+ product the best public image.

Disney's plan long-term is to leverage the stickiness of their content and their platform to be able to raise prices. They see that Netflix makes $17 per subscriber. So Disney wants to mirror that. Move from $8 -> $17 in a few years. But they're not there yet. At the moment, they're churning thru content and still not commanding Netflix's pricing power.