https://www.wsj.com/business/media/...gure-out-streaming-f24a32b1?mod=hp_lead_pos11

Disney’s Thriving Parks Are Buying It Time to Figure Out Streaming

Parks and cruises are helping, but company-wide profit margins are still well below the cable bundle’s heyday

By

Dan Gallagher and

Ben Fritz

Aug. 7, 2025 - 5:30 am EDT

Disney was once a giant media company that also happened to own some theme parks. The new Disney is quickly turning into the opposite.

The company’s

latest quarterly report Wednesday drove that point home even further. Disney’s revenue and operating income were roughly in line with Wall Street’s estimates despite weaker-than-expected revenue growth at its entertainment and sports divisions. The main source of strength was domestic parks, which saw revenue jump 10% from a year earlier to $6.4 billion and operating income surge 22% to nearly $1.7 billion.

Both exceeded analysts’ targets during a quarter in which Disney saw the launch of a major new competitor: Universal’s new

Epic Universe theme park in Orlando, Fla. Disney said Wednesday that its Walt Disney World park in the same city saw record revenue for the June-ending quarter.

Theme parks include Disney’s fast-growing cruise-ship business, which will get two new vessels later this year. The costs for those launches will weigh on the division’s bottom line a bit. And the company’s international parks unit saw operating income drop 3% year-over-year to $422 million, which the company blamed in part on weak spending at its two parks in China.

Still, the long-term resilience of the theme-parks business against new competition, weakened consumer spending, global trade tensions and even a worldwide pandemic has been remarkable. And it has saved Disney from much of the pain being experienced by rival media companies grappling with the meltdown of the

traditional cable-TV business and a theatrical market still well off its prepandemic highs.

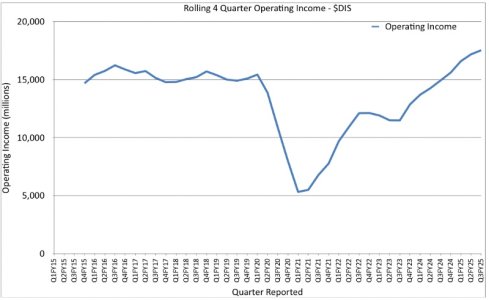

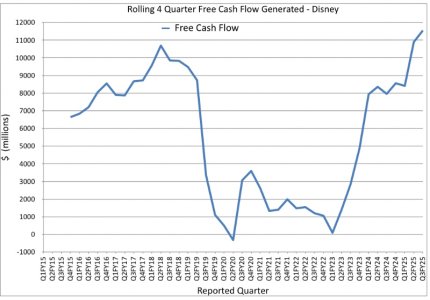

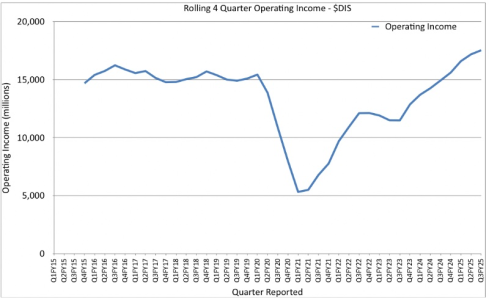

But those are still problems for Disney too. The cable-TV shrinkage in particular has left a rather large gap on the company’s income statement. Annual operating income for linear networks is down by more than a billion dollars in just the past two years.

Theme parks have offset some of that loss. Domestic and international parks now account for 43% of Disney’s annual operating income compared with 21% a decade ago. But Disney’s overall operating margin is now around 19%—nearly 10 points below its level from a decade ago. That reflects both the loss in linear TV profits and the addition of streaming revenue that currently brings in much lower margins.

As a result, Disney’s operating profit last year was $15.6 billion—very close to the $15.7 billion peak all the way back in fiscal 2016. But that past record was on $55.6 billion in total annual revenue, which is now above $90 billion.

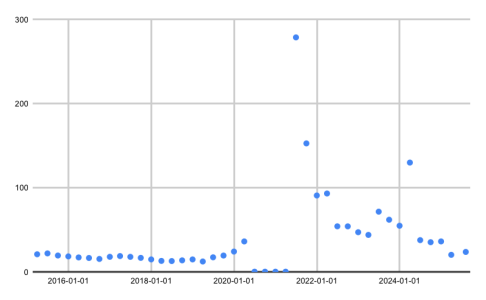

Streaming margins will likely improve. They need to. That business generated $346 million of operating income on $6.2 billion of revenue last quarter, a margin of nearly 6%. Disney has said it would increase that to 10% and then wants to take it higher.

Getting there will require different strategies domestically and abroad. In the U.S., where subscriber growth has plateaued, Disney wants to reduce churn by convincing people to subscribe to all three of its streaming services, making it likely they will watch more stuff and won’t cancel. That is why it costs so little to add Hulu and the soon-to-launch ESPN streaming service once you’ve got

Disney+, and vice versa.

Overseas, Disney is investing in local streaming content, at least in certain markets. It is also trying to improve its recommendation algorithm, which is currently no match for Netflix’s, particularly when it comes to the Hulu and ESPN content that bundle subscribers can watch on Disney+.

Those are the right moves to be making. And the potential for streaming to boost Disney’s bottom line is there. Netflix is now generating an annual operating margin around 30%. But that is after nearly two decades in streaming and off a base of more than 300 million paying subscribers, which is nearly 100 million more than the total number of Disney+, Hulu and ESPN subscriptions that Disney now reports.

Disney, in other words, still has a lot of catching up to do in the streaming race. Its parks and cruise ships are making that ride a bit easier.

Write to Dan Gallagher at

dan.gallagher@wsj.com and Ben Fritz at

ben.fritz@wsj.com