The Walt Disney Company Q3 FY 25 Earnings Report

Financial Results for the Quarter:

• Revenues increased 2% for Q3 to $23.7 billion from $23.2 billion in Q3 fiscal 2024

• Income before income taxes increased 4% for Q3 to $3.2 billion from $3.1 billion in Q3 fiscal 2024

• Total segment operating income(1) increased 8% for Q3 to $4.6 billion from $4.2 billion in Q3 fiscal 2024

• Diluted earnings per share (EPS) for Q3 improved to $2.92 from $1.43 in Q3 fiscal 2024, and adjusted EPS(1) increased 16% for Q3 to $1.61 from $1.39 in Q3 fiscal 2024

Key Points:

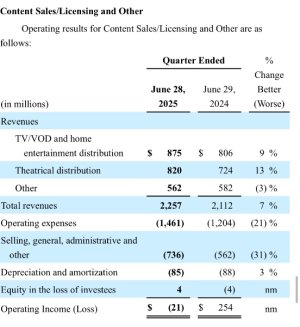

• Entertainment: Segment operating income of $1.0 billion, a $179 million decrease versus Q3 fiscal 2024

◦ Direct-to-Consumer revenue increased 6%, which included an adverse impact of 3 percentage points due to

Disney+ Hotstar being included in the prior-year quarter’s results

◦ Direct-to-Consumer operating income increased $365 million to $346 million

◦ 183 million Disney+ and Hulu subscriptions, an increase of 2.6 million versus Q2 fiscal 2025

◦ 128 million Disney+ subscribers, an increase of 1.8 million versus Q2 fiscal 2025

◦ Linear Networks operating income declined $269 million versus Q3 fiscal 2024 largely driven by the Star India transaction

◦ Content Sales/Licensing and Other declined $275 million versus Q3 fiscal 2024, reflecting the performance of titles in the quarter compared to the strong performance of Inside Out 2 in the prior-year quarter

• Sports: Segment operating income of $1.0 billion, an increase of $235 million versus Q3 fiscal 2024

◦ Year-over-year increase reflects the impact of a $314 million loss at Star India in Q3 fiscal 2024

◦ Domestic ESPN operating income declined 7% versus the prior-year quarter primarily due to higher programming and production costs reflecting contractual rate increases for the NBA and college sports

◦ Domestic advertising revenue growth of 3%

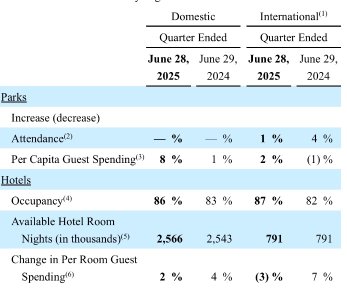

• Experiences: Segment operating income of $2.5 billion, an increase of $294 million versus Q3 fiscal 2024

◦ Operating income in the quarter reflects a ~$40 million benefit from timing of the Easter holiday, and a ~$30 million impact from pre-opening expenses at

Disney Cruise Line

◦ Domestic Parks & Experiences operating income grew 22% to $1.7 billion