AlpacaLips

Earning My Ears

- Joined

- May 29, 2025

- Messages

- 8

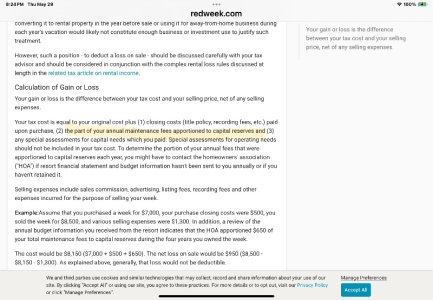

I'm hoping someone will be nice enough to look at their old Grand Californian statements or annual reports to tell me the percentage of Grand Californian dues in 2011, 2012, and 2013 that were applied toward reserves. (I sold a contract last year for a profit, and my understanding is that the "reserves" portion of dues are tax-deductible.) Unforutnately, I don't have documents for these years, and while Disney can provide them, they have not responded in a timely manner and I'm working under a deadline.

To clarify, I'm not looking for the total dues percentage (which are easy to find online); I'm looking specifically for the "reserves" line item for those years. This can be found both on individual annual statements, and in the general annual report for Disney's Grand Californian that DVC sends out to members each year.

If you can help me out with this, I'd really appreciate it.

To clarify, I'm not looking for the total dues percentage (which are easy to find online); I'm looking specifically for the "reserves" line item for those years. This can be found both on individual annual statements, and in the general annual report for Disney's Grand Californian that DVC sends out to members each year.

If you can help me out with this, I'd really appreciate it.