You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Cake Bake Shop at the BoardWalk is now open

- Thread starter crazy4wdw

- Start date

Minnie1222

DIS Veteran

- Joined

- Oct 25, 2018

- Messages

- 3,920

"Word on the street" is not a verified source.Posted over on wdwmagic....Can't say I'm surprised.

"So word on the street is the cake bake just cut their front line employees hourly base pay"

If this were true, it's time y'all step up and tip your servers more.

LoveDaisy

DIS Veteran

- Joined

- Jul 8, 2022

- Messages

- 2,559

What’s the source of the rumor?Posted over on wdwmagic....Can't say I'm surprised.

"So word on the street is the cake bake just cut their front line employees hourly base pay"

Edit: Salaries from Indeed

han22735

DIS Veteran

- Joined

- Mar 24, 2014

- Messages

- 1,940

I understand....just posted for info purposes. But that poster isn't just a random person..they do have some inside info regularly."Word on the street" is not a verified source.

If this were true, it's time y'all step up and tip your servers more.

Minnie1222

DIS Veteran

- Joined

- Oct 25, 2018

- Messages

- 3,920

Are they reducing the hourly pay of an existing employee? Or offering a potential employee a lower rate than a previous year?

CarolynFH

DIS Legend

- Joined

- Jan 5, 2000

- Messages

- 20,753

How can I say this without getting into controversial politics? DH speculated that when tips became non-taxable, employers of tipped personnel would decrease their base pay (which is lower than non-tipped minimum wage because tips are expected to make up the difference and more) because the employees will be keeping more of their tips. So maybe cutting existing salary can mean more than one thing. I have no knowledge, just speculation.I read it as cutting existing salary...which would mean only one thing....sales aren't where they need to be.

Or sales are great. Tips are great. Hourly pay is higher then necessary.I read it as cutting existing salary...which would mean only one thing....sales aren't where they need to be.

0FF TO NEVERLAND

DIS Veteran

- Joined

- May 7, 2018

- Messages

- 2,531

Deleted

Mike&AllisMom

DIS Veteran

- Joined

- Jan 11, 2009

- Messages

- 698

The states set the tipping wages so they can't go below the state guidelines. They can only cut the pay if they were already paying more than the state minimum.How can I say this without getting into controversial politics? DH speculated that when tips became non-taxable, employers of tipped personnel would decrease their base pay (which is lower than non-tipped minimum wage because tips are expected to make up the difference and more) because the employees will be keeping more of their tips. So maybe cutting existing salary can mean more than one thing. I have no knowledge, just speculation.

CarolynFH

DIS Legend

- Joined

- Jan 5, 2000

- Messages

- 20,753

Good to know.The states set the tipping wages so they can't go below the state guidelines. They can only cut the pay if they were already paying more than the state minimum.

keishashadow

Proud Redhead...yes, I have some bananas!

- Joined

- Dec 30, 2004

- Messages

- 32,630

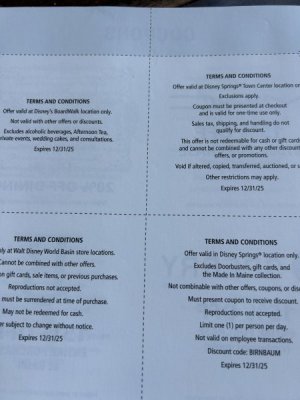

Late to the thread...Just wanted to share... The Birnbaum book continues to drop in price on Amazon, as we get later into 2025. I just bought a 2nd copy yesterday, under $11. We'll be using the coupon this weekend, and then again in December.

Coupon? Would that be 20% off cake Bake shop?

Last edited:

Yes, that’s the one and it’s readily accepted at the restaurant.Late to the thread...

Coupon? Would that be 20% off cake Bake shop?

Beth

Just happy to be here...

- Joined

- Aug 17, 1999

- Messages

- 1,828

Yep! We just used it last week, no problem at all! The book really has a LOT of good coupons!Late to the thread...

Coupon? Would that be 20% off cake Bake shop?

It’s also currently available on Amazon at a reduced price.Yep! We just used it last week, no problem at all! The book really has a LOT of good coupons!

musika

Everybody wants to be a cat.

- Joined

- Oct 30, 2017

- Messages

- 732

Is there a list somewhere of the coupons included?Yep! We just used it last week, no problem at all! The book really has a LOT of good coupons!

kylenne

Wakandan-American

- Joined

- Oct 16, 2016

- Messages

- 6,288

I have the book from this year and the overwhelming majority are for restaurants and things at Disney Springs. I'm at work rn so I can't get into specifics but it's stuff like Splitsville, the AMC theater, etc. I can type out a full list when I get home.Is there a list somewhere of the coupons included?

Excludes alcoholic beveragesCan the coupon be used for cocktails or only food/non-alcoholic beverages?

-

Why I Believe We Are FINALLY Entering the Post-Chapek Era of Disney Imagineering

-

The Perfect Gift for a Loved One's Disney Vacation

-

Is Jock Lindsay's Hangar Bar at Disney World the Most Festive of Them All?

-

Are the Holiday Weekends in Disney Parks Overrated?

-

What You've Missed This Week in NEW Disney Pins

-

2025 EPCOT Festival of the Holidays Begins at Disney World

-

Visiting Disney Shouldn't Be a Social Status Symbol

New Threads

- Replies

- 0

- Views

- 16

- Replies

- 2

- Views

- 189

- Replies

- 1

- Views

- 212

- Replies

- 0

- Views

- 195

- Replies

- 3

- Views

- 264

Receive up to $1,000 in Onboard Credit and a Gift Basket!

That’s right — when you book your Disney Cruise with Dreams Unlimited Travel, you’ll receive incredible shipboard credits to spend during your vacation!

CLICK HERE

That’s right — when you book your Disney Cruise with Dreams Unlimited Travel, you’ll receive incredible shipboard credits to spend during your vacation!

CLICK HERE

New Posts

Resort Thread

Disney's WILDERNESS LODGE

- Replies

- 2K

- Views

- 295K

- Replies

- 9K

- Views

- 1M

- Replies

- 98

- Views

- 7K

- Replies

- 3K

- Views

- 438K

- Replies

- 23

- Views

- 1K