I think you should include resale RIV in your analysis. Large stripped contracts can be had for under $120/pt. and loaded contracts are pretty easy to get under $130. Based on its many years remaining and low upfront cost, resale Riviera points are arguably the cheapest to own right now. For people who love Riviera and plan to use their points there exclusively, resale can be a great deal. Rental demand for Riv points is also good. Also, if someone wants to stay at Riv, they won't be able to if they buy anything but Riv resale.

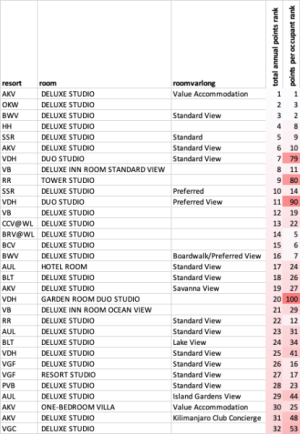

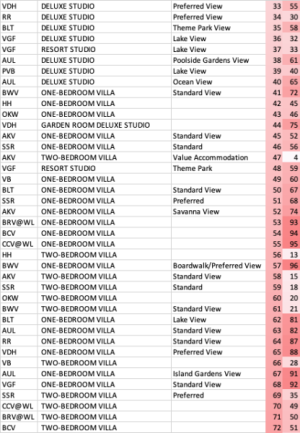

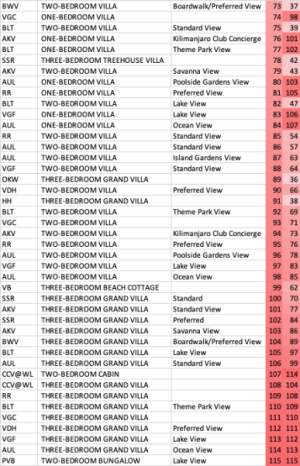

Based on Spring 2023 data here is my ranking from a similar Present Value analysis. Looking forward to see how yours comes out.

Ranked from lowest cost to own per point (assumes contract is held to expiration). My rank compared with

DVC Resale Market's Spring 2023 ranking.

My rank // (

DVC Resale Rank)

1. Riviera // (Grand Floridian)

2. Saratoga Springs // (Riviera)

3. Aulani // (Saratoga Springs)

4. Grand Floridian // (Copper Creek)

5. Copper Creek // (Polynesian)

6. Polynesian // (Bay Lake Tower)

7. Bay Lake Tower // (Aulani)

8. Animal Kingdom // (Animal Kingdom)

9. Hilton Head // (Old Key West)

10. Old Key West // (Boulder Ridge)

11. Boulder Ridge // (Hilton Head)

12. Vero Beach // (Grand Californian)

13. Boardwalk // (Boardwalk)

14. Beach Club // (Vero Beach)

15.

Disneyland Hotel (Direct only) // (not ranked)

16. Grand Californian // Beach Club

For what it's worth, there's only a 10% difference in cost per point between #1 and #8. You'll also notice that my 1-8 rankings include all the same resorts as DVC Resale Market's 1-8 rankings. And between #3 and #7 there's only a 3% difference in cost per point. Depending on how the monthly data fluctuates, I find #3 thru #8 switch places fairly frequently because the cost to own them is so close.

#9-#16 are much more expensive than 1-8. As noted the difference between 1 and 8 is only 10%, yet the difference in cost between #8 and #9 alone is ~12% in my analysis. The difference between #1 and #16 is a whopping 60%. The big jump in cost to own comes mostly as a result of the shorter 2042 contract expiration. Disneyland Hotel and Grand Californian are at the bottom of the list because of the very high upfront cost.

My rankings differ slightly from DVC Resale market because I take inflation of dues and cost of capital into consideration, assuming a fairly high discount rate of 6.75%. That's why Disneyland Hotel and Grand Californian fare far worse in my analysis - the upfront cost is very high and the DVC Resale market rankings don't factor in cost of capital.

The only thing you can definitively say is 1-8 are the "affordable" options and 9-16 are the "expensive" options.

The wild card that's not factored into the analysis is whether someone will resell their contract before expiration (very likely) and which resorts will appreciate the fastest. Because that is unknowable, and the "cost per point" for 1-8 is so close, I think any of the resorts in the 1-8 rank (RR, SSR, AUL, VGF, CCV, PVB, BLT, AKV) have an equal chance of "coming out on top." Though if I was betting on the Trifecta, I'd pick 1. Grand Floridian 2. Copper Creek 3. Polynesian (but I think Poly Tower will be same association. For those who think Poly Tower will be separate I'd go 1. Grand Floridian 2. Copper Creek 3. Bay Lake Tower