Back from seeing my 5 BFs in Vegas. I stayed at Resorts World night 1 on the Hilton Team member rate. I confirmed 2 adults at check in, but when it came to awarding the F&B credit they only gave me $15. So I'm fighting them. Night 2 I stayed at Vdara. We're still MGM Gold somehow from the MGR, and they upgraded me to a fountain/sphere room and a big suite

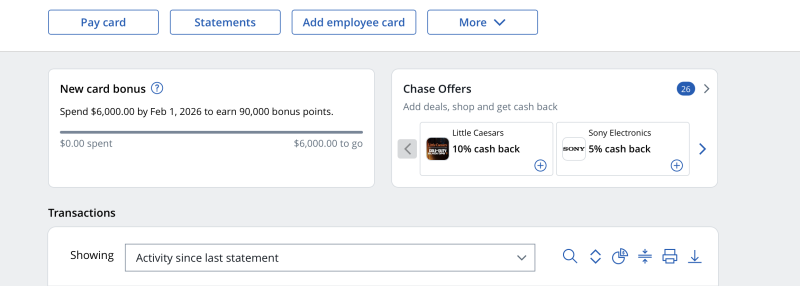

I got my Ink just before I left so I was trying to use it in Vegas. It was weird because it got denied some places, but not others. Then today it was denied again at home. I just logged on to check to see if I had a tracker, they only gave me a $3k line. And since I paid for my daughter's tuition, it's maxed, LOL. Oh well. I guess I'm 1/2 way to the SUB. And I have until 2/6. So I think I'll be good to hit it.

I'm debating my Cap 1 card. I'm approaching the year mark on it. So far I've used the $300 credit to book rental cars. And the Hertz President's Circle has been worth it. With the change in the lounges only going to the main card holder, it seems pointless. Plus they apparently don't allow non-revs in the Cap 1 lounges. I had my first chance to try in Vegas. I know DFW wasn't letting non-revs. but I thought maybe it was just that location. Nope, the fine print says you MUST have a seat assigned. Which is crazy because there are a lot of paid ticket options that assign seats at the gate. Considering I NEVER have a seat assigned, and the PP lounges (who will let in non-revs), it seems stupid to keep the card for president's circle. Especially since the 2 times I've used it, it's been basically the same car I rented, just nicer trim package. I have no idea what to do w/ my Cap 1 points. Is there a card I should PC to? It looks like the Venture X Business will still allow guests at PP lounges. Other than the fact I won't get the SUB, does anyone have the Venture X Business?

Also it's not like there are a ton of places w/ travel we're hitting the lounge. DTW we fly out of the Delta side, which means no lounges. The places we go often (Vegas, and Cancun) have crappy lounges. The one in Munich was okay enough....we avoid layovers, lol. And most of the time, we don't get to the airport early in hopes of hanging out in the lounge, LOL. I'm trying to figure out if there is a card w/ lounge access that makes sense. I never got to try the CSR lounges w/ non-rev tickets. But I don't think I can stomach the AF. I've debated doing Amex Plat, but always decide not to. What are people doing these days? Are we all just ditching the "premium" AF cards?