So I'm going to come out and say that the values posted by Webmaster Doc are simply misleading. Anyone can go on dvcmember.com and look at their dues. The tax adjustment was put in place before any bill was sent to anyone.

I don't think anyone ever claimed that those were the amounts billed. Those are the annual budget projections as issued by DVC. Are the numbers a perfect representation of the cost of owning DVC? No. But going back 20 years they are the only numbers publicly available for all resorts.

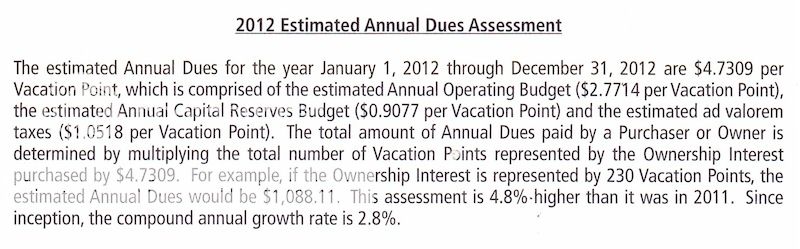

So no matter if you paid on a monthly basis or all at once, you still pay the same amount. That amount was NOT $4.73/point this last year for SSR.

Depends.

If you purchased SSR points direct from DVC on January 1, 2012 then $4.73 per point is the EXACT amount you would have paid for the year. A buyer on 1/1/12 would not have received any adjustment from 2011.

This also illustrates another way in which adjustments complicate matters. Dues are pro-rated from the date of purchase and the corresponding adjustments / corrections will also be pro-rated.